How I Learn more with Shortform

As someone who’s always trying to squeeze more learning into my day, I’ve made Shortform my go-to platform for non-fiction summaries. Shortform is more than just another summary tool.

Unlike other book summary services, Shortform dives deep. With its meticulously crafted chapter breakdowns, in-depth analyses, insightful counterpoints, and comprehensive guides, Shortform doesn’t just help you read—it helps you understand.

Graham’s Newsletter readers get a free trial PLUS 20% off, so you can finally dive deep into some of my favorites like:

Four Thousand Weeks: Take charge of your time and live your life to the fullest with lessons from Oliver Burkeman.

Endurance: Get inspired by Shackleton’s impossible voyage across the South Atlantic.

Don’t let a busy schedule limit your potential.

Not long ago, billionaire investor Ray Dalio released a 43-minute video titled Principles for Dealing with the Changing World Order. Dalio’s talk was about his interest, obsession, and forte – the rise of great empires and how they begin to fall when there is a contender on the scene. At the time, it sounded like he was being over-pessimistic. But with everything that’s going on in the market now, his prediction is coming back to haunt investors.

Dalio is not a doomsday prophet. With over 50 years of experience and as the founder of the world’s largest hedge fund (Bridgewater Associates), he’s one of the most respected macro-investors of our time. In 2016, he had warned about monetary overreach, that central banks would “get so desperate that they’ll give away money.” Just four years later, during COVID, this came true.

Today, Dalio says we’re watching the exact shift he warned about unfold in real time: weakening trust in the U.S. dollar, rising global division, mounting debt, and eroding American leadership. At the heart of this shift is what we fear most – the decline of the US dollar as the global reserve currency. Let’s understand what that means:

What Is a Reserve Currency?

A reserve currency isn’t just a preferred mode of payment – it’s the financial operating system for the global economy. The world has moved from a paradigm of focusing on local economies to a multilateral global economy where all countries are connected by trade. The reserve currency of the world is their common standard – they don’t just hold it in their central banks, they price oil in it, they borrow in it, and even peg their own currencies against it.

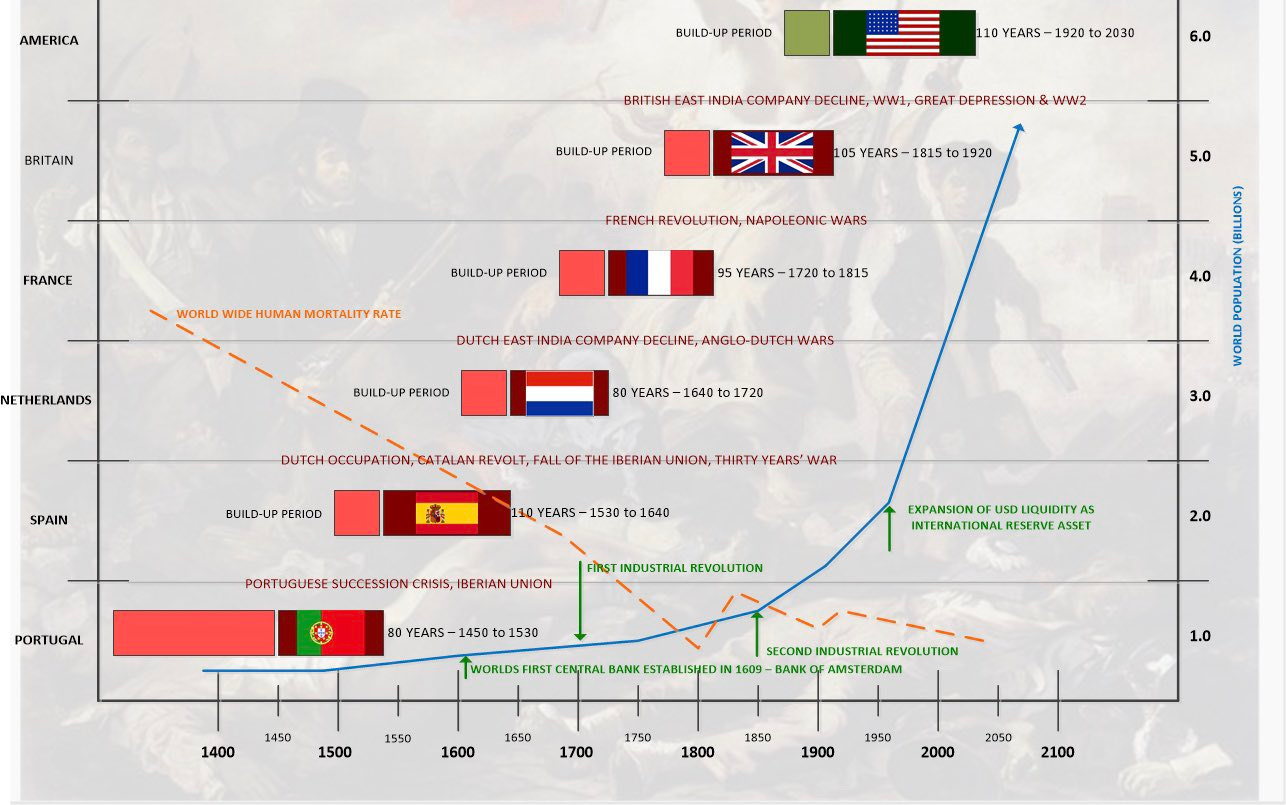

Since 1945, that currency has been the U.S. dollar. But before that, it was the British pound. Before the pound, it was the Dutch guilder... Reserve currencies rise and fall roughly every 80–100 years:

Looking at it that way, we’re now in year 80 of dollar dominance. That timing isn’t a coincidence. In their book The Fourth Turning, William Strauss and Neil Howe argue that societies undergo major upheavals roughly every 80 to 100 years – because that’s the average lifespan of a long human life. You’ve probably heard this quote:

Hard times create strong folks. Strong folks create good times.

Good times create weak folks. Weak folks create hard times.

That’s roughly how it plays out – the times of prosperity are won by fighting against a crisis, and that crisis shapes people who know the importance of working hard and shaping institutions. But as this generation grows old and dies out, their lived experience fades out of memory, and those who follow them either take their stability for granted or don’t develop the skills to protect and build institutions. Trust erodes, and the cycle resets, not because people forget the facts but because they don’t feel the cost of disorder in their bones.

The last such upheaval was the Great Depression followed by World War II – events that shaped the American-led world order and cemented the dollar’s dominance. That was nearly a century ago. We may not be at the end of the story, but we are, perhaps, at the turn of a page.

Where we are in the cycle of power

Ray Dalio says that every empire goes through three stages: the Rise, the Top, and the Decline. No nation is an island – it’s always a tug of war between a great power and a rising power that might grow into a challenger. The last time this happened was when the British empire and the United States faced off.

1. The Rise

The British Empire reached its peak in the 19th century – it was powered by industrial innovation, and it dominated with its navy and its global trade network. The British pound was the global reserve currency, and a symbol of stability and trust. By the early 20th century, its grip was loosening when the United States emerged as the rising power. The US wasn’t a contender when it won the Revolutionary War and rejected British rule. But since then, it had pioneered its own national experiment powered by open markets and innovation.

America industrialized rapidly, won two world wars, and controlled the postwar global system through institutions like the UN, IMF, and the World Bank. With the dollar at its center, the U.S. became the hub of trade, technology, and investment.

2. The Top

The Cold War ended in the 1990s. If there was a moment when the United States stood unquestionably at the top, this might have been it. The Soviet Union had collapsed. Silicon Valley was born in the semiconductor boom and the Internet was born on American soil. The dollar reigned supreme. American companies dominated global markets.

Productivity soared.But so did leverage.

As the dollar’s buying power grew, manufacturing was outsourced. This caused debt to grow, and inequality widened as our local manufacturing base weakened. America grew richer and less self-reliant at the same time. According to Dalio, this is a familiar turning point in any empire’s cycle: where comfort begins to erode discipline, and the same factors that make an empire successful also set up its decline.

3. The Decline

This is where he believes we are now. The signs are visible: rising inflation, widening distrust in institutions, record debt levels, and growing skepticism of the dollar from other countries. Just as the British pound once ceded its place to the dollar during a long, reluctant transition, we may be living through a similar handoff. It won’t happen in a single moment (maybe not even in our lifetime) – but it didn’t for the British either. However, the echoes are growing louder.

“Empires behave as though they are eternal. They last for a heartbeat in the scheme of things.”

– Niall Ferguson, historian

This is the full video by Ray Dalio and it’s worth watching.

Howard Marks: Globalization Is Ending

Howard Marks of Oaktree Capital is another person who understands market cycles with laser clarity – investment giants look forward to his memos to make sense of the market climate, including Warren Buffett. For Marks, empire cycles aren’t the only issue – it’s globalization itself.

What we’ve seen so far isn’t “natural” or the way things always worked. For decades, American companies thrived on cheap labor abroad, especially in China, keeping prices low and inflation tame. Now the world is shifting back to regionalization. Supply chains are contracting, manufacturing is becoming local, and and production costs are growing as a result. Meanwhile, these countries with cheap labor also relied on America as a marketplace, and that’s going to change.

Marks predicts that defense, aerospace, infrastructure, and commodities will rise, while tech firms with high debt and global supply chains could struggle (defense could be the new tech gold rush, as per this article by

). Volatility might also return to markets that had grown comfortable with easy money. But he sees this as an opportunity: “This might be a time to sniff around for bargains… the babies thrown out with the bathwater.”The Warning Signs Are Everywhere

Forget what the macro experts are saying. Even if you just look at the data, the market is sounding alarms:

Debt-to-GDP is now at 122%, a level not seen since World War II.

Interest payments now exceed military spending.

The bond market is behaving unpredictably too. When stocks fall, investors usually flee to treasuries as a safe heaven and prices rise. But in April, treasuries were also sold off. Confidence might be falling not just in US markets but also in the US government.

According to Deutsche Bank, this is a sign of rapid de-dollarization, i.e nations no longer see the dollar as a safe haven. The Federal Reserve even stepped in to assure markets that it would “intervene” if liquidity dried up. There are even rumors that China is actively selling U.S. Treasuries to drive up borrowing costs and destabilize American finances but take this with a grain of salt because there’s no proof that any particular country is responsible.

All this to say that the bond market is also flashing warnings supporting Dalio’s claims that we’re seeing a paradigm shift and that it’s not just temporary chaos. Since then, the market has thankfully recovered somewhat, but here are my thoughts on:

What This Means for You

The theory behind this might sound a bit abstract. But if the U.S. dollar does lose its reserve status, the effects will ripple through every layer of American life.

Borrowing becomes expensive: Interest rates on mortgages, credit cards, and student loans will all rise.

Inflation rises: A weaker dollar makes imported goods more expensive.

Investments become volatile: Capital flows out of U.S. equities. Growth slows. Stock valuations correct.

Geopolitical power erodes: Sanctions lose force. Trade deals get harder to enforce. America’s global influence weakens.

International shift: Countries like China may use this moment to push alternatives like the yuan, BRICS-backed digital currencies, or gold reserves.

What Investors Should Do

While no one can predict exactly how or when this plays out, there are sensible ways to adapt. First, think about this long-term. Don’t try to time the market by listening to news cycles and continue to invest steadily if your horizon is decades-long. Second, having some exposure to alternative assets like a Bitcoin ETF offers asymmetric upside if confidence in the dollar does erode. Thinking long-term is great, but to get to the long term you need to go through the short term – so maintain an emergency reserve and income to sustain your investments and expenses through periods of volatility.

Like Howard Marks says, periods of uncertainty can also create bargains and opportunities when everyone “throws out the baby with the bathwater.” To capitalize on this, you need to have cash on the sidelines and not overreact. If a structural change does happen, it will happen over decades – the British Empire didn’t collapse overnight, and diversifying a small portion of your assets across international stocks could be a safe move.

Dalio and Marks aren’t selling fear. What they’re doing is pattern recognition. The next 10 years won’t be a repeat of the last 10, but that’s a call for adapting, not for panicking. What matters is how you prepare, invest, and endure.

That’s it for today. If you found that useful, please share it with a friend (hitting “restack” lets more people see it) and drop a comment with your thoughts. And don’t forget to check out today’s sponsor, Shortform!

Has bitcoin actually been moving opposite of the USD strength? I don't think I've seen that.

Will DOGE's efforts help prolong the USD as the reserve currency?

Good stuff, Graham - I posted a similar essay today, albeit with a different tone and more of a stage setter for future writing. End of a cycle, or end of a regime?