Every high-performer has a playbook. This is yours.

Wealth isn’t built by doing more. It’s built by doing less of the wrong stuff.

Upwork helps you stay in your zone of genius by handling the rest. That includes AI, marketing, design, development, finance, and more.

Top talent. On demand. No bloated payroll or long-term overhead.

Only pay for approved work

Hire fast, scale on your terms

Build with intention

Focus on what only you can do. Outsource the rest.

The Federal Reserve just flipped the script.

A couple of days ago, Jerome Powell hinted that rate cuts might be coming much sooner than expected. That’s right – after months of fighting inflation, the Fed is quietly admitting two uncomfortable truths:

The jobs market looks weaker than anyone thought.

Inflation above 2% may be the new normal.

Instead of doubling down, the money printer might be warming up again. We all know what happens when the printer turns back on…

This shift could be wildly profitable for investors, but it also comes with some serious risks if you aren’t careful. So let’s break down exactly what Powell just said, the surprises hidden in the latest jobs report, and what this all means for your portfolio.

The Fed’s intentions have changed in the span of less than three weeks. To stay on top of the situation as it changes and protect your investments, subscribe for free:

The signal before the move

The Federal Reserve doesn’t like surprises that throw the stock market into a frenzy. If they’re going to move, they usually telegraph it first so the markets have time to adjust. And Jerome Powell just gave us that signal, hinting that rate cuts may be coming sooner than anyone expected.

Unemployment is still relatively low, but Powell admitted that “downside risks are rising,” and that “conditions allow us to proceed carefully as we consider changes to our policy stance.” Here’s what that means in plain English: the Fed is pivoting from “we won’t cut until tariffs are resolved” to “we may have to cut sooner to protect jobs.”

Powell wasn’t vague or mysterious. He warned simply that risks to employment are increasing, and if they materialize, it could mean “sharply higher layoffs and rising unemployment.” That’s a dramatic shift from just a few weeks ago, when the Fed was pushing back hard against rate cuts, even when they were being pressured by the President to do the opposite. For the record, Powell insists the Fed is still independent and that decisions will “be based solely on the assessment of the data and its implications for the economic outlook and the balance of risks.”

But here’s where things get messy. Powell isn’t a one-man show. Interest rate decisions are voted on by seven board members and five regional Fed presidents. And right now, one of those board members, Lisa Cook, might be on the chopping block. Trump wants rate cuts, lots of them, and while he can’t directly order the Fed around, he can remove board members “for cause.” That usually means misconduct or neglect of duty. In Cook’s case, critics point to a 2021 controversy where she allegedly listed two different properties as her primary residence on loan applications. She responded by saying she’s gathering the facts to answer any legitimate questions.

Depending on whom you ask, Trump is either trying to strong-arm the Fed by digging up dirt, or raising valid concerns while pushing for faster rate cuts to “save” the economy. Either way, Powell ended his speech with something far bigger: a brand-new policy that could change the entire economic outlook…

The Fed’s New Playbook

The real shocker from Powell’s meeting isn’t that the Fed is calling a new play. It’s that the Fed is changing its entire playbook.

For decades, the central bank has had one obsession: to get inflation back to 2%. Now, why this magical number of 2%? Honestly, there’s no good reason: Someone in New Zealand basically made it up in the early 1990s. They originally aimed for 1% inflation, then bumped it to 2% for wiggle room. That “rounding error” turned into gospel, and every central bank followed suit.

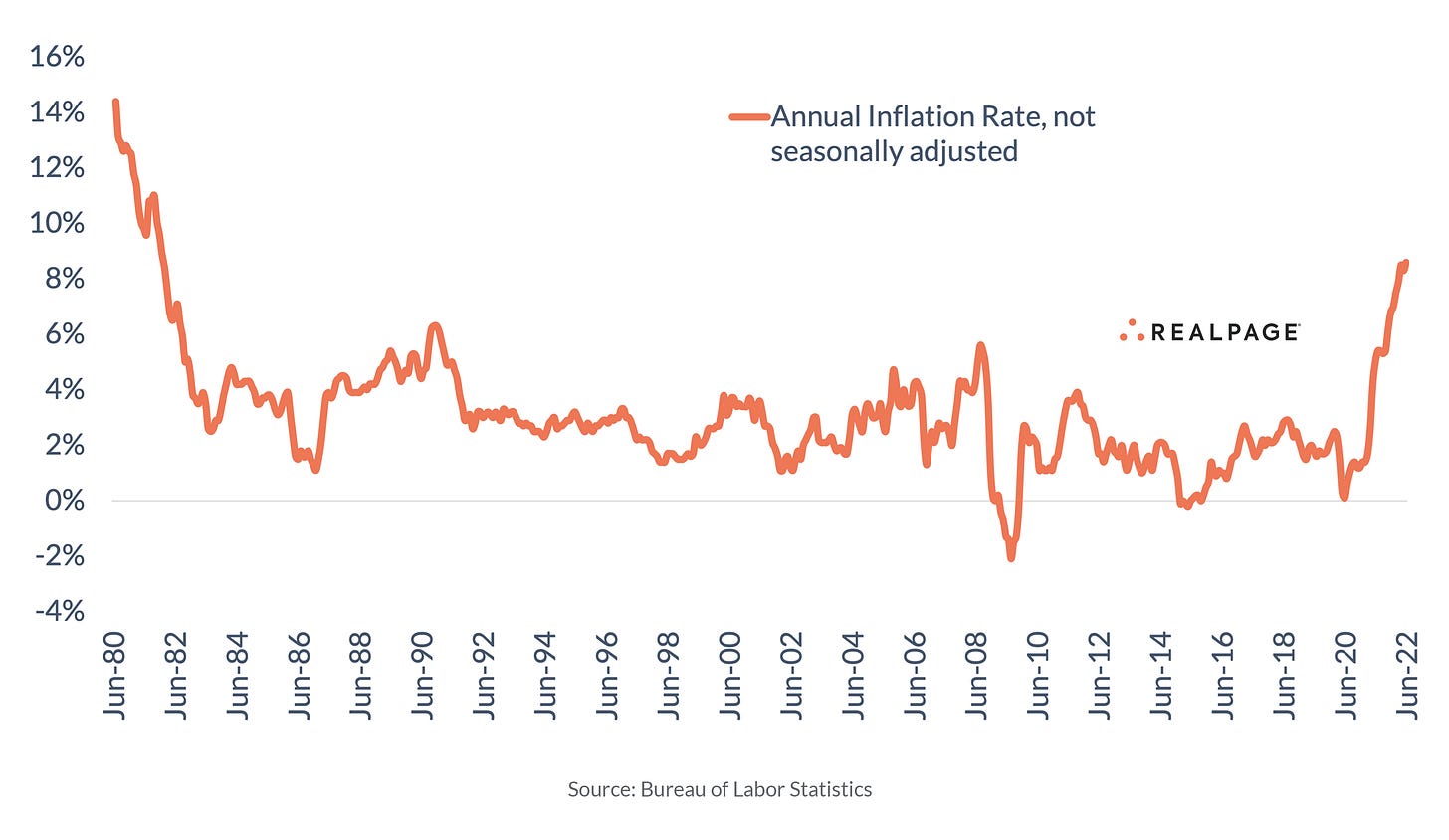

The idea was simple: too little inflation makes people hoard cash, and too much erodes savings. 2% was the sweet spot. For years, inflation stayed under that line. Between 2014 and 2016, it was practically zero. Back then, the Fed’s strategy was straightforward: aim for 2% every year. If you missed, try again next year.

Then 2020 hit, and the Fed rolled out something new: the “Make Up Strategy.” The logic went, if inflation has been too low for years, we’ll let it run a little above 2% for a while to even things out. That sounds neat on paper, except it lead to inflation shooting up to 7%. Powell admitted this week that there was nothing “good” about inflation getting to 7%, and the Fed has now tossed it out.

Now here’s the latest strategy: flexible average inflation targeting.

Here’s what it means: the Fed will still say they’re aiming for 2%, but they’ll be flexible about it. Some years inflation may run higher, some years lower, and as long as it doesn’t spiral out of control, that’s fine. In practice, this gives them the leeway to tolerate inflation above 2% without keeping rates painfully high. Put simply, the “new normal” could mean living with inflation above 2%, while still getting rate cuts. Markets are already betting on it. As of today, there’s an 87% chance of a rate cut at the Fed’s September 17th meeting.

So, is this good for the economy, or are we just kicking the can down the road? Let’s talk about what it really means for your money.

The Case for (and Against) a Rate Cut

So, why is the Fed even considering cutting rates right now?

1. The jobs market is stumbling: July’s report showed just 78,000 new jobs. This is way lower than expected and it’s raising concerns the labor market could be in serious trouble. A rate cut would be one way to stimulate growth.

2. Trump argues it would save nearly $1 trillion per year: Lower rates mean lower interest payments on the national debt, which adds up fast.

3. Inflation is calming down: For the past 12 months, inflation has stayed under 3%. Even with small month-to-month upticks, Trump says the Fed should cut now before Powell ends up “too late.”

But here’s the flip side. Others think cutting rates now would be a mistake because:

1. Wholesale inflation is heating up: The Producer Price Index, which tracks what businesses pay for raw materials, jumped 0.9% in July, well above forecasts. That eventually flows through to consumers.

2. Consumer inflation is inching higher again: Prices rose 0.2% month-over-month, which, if sustained, puts inflation above the Fed’s “flexible” 2% target.

3. The labor market is still strong: Unemployment is sitting at 4.2%, near record lows. Rate cuts are usually reserved for recessions, not boom times.

4. Tariffs remain a wild card: Powell has already said tariffs were the main reason cuts didn’t happen sooner. He admitted they may just be a temporary blip, but until that clears up, the Fed is cautious.

So what does this mean for investors on the whole?

Taken together, Powell’s new “flexible” approach to inflation is a bullish signal. It means the Fed won’t feel locked into forcing inflation all the way back to 2% before acting. And right now, Powell seems to be hinting strongly that we could see rate cuts as early as September.

That said, there’s a weird contradiction here: the Fed is talking about cutting rates even while stocks, housing, and crypto are near all-time highs. That could easily fuel another surge in asset prices. But if you’re invested, this is good news for your portfolio, and markets are already reflecting it.

If you read this far, let me know what you thought by commenting: Great | Good | Meh | Terrible at the bottom. I read every single comment and email reply.

Don’t forget to check out today’s sponsor. I’ll see you next week!

Graham I find these notes VERY helpful...an understandable digestible summary of economic and market news. They're pretty timely too but they'd be even more useful if they were sometimes more than one a day of important developments came out. I'm too much of a novice to interpret most economic news but your explanations help me REALLY understand what it all means!