Why homes are so expensive (it's not what you think)

Practical ways to make starter homes affordable

The year’s almost over. Your to-do list isn’t.

Upwork Business Plus connects you with top freelancers in marketing, design, and AI so you can actually finish the year strong. No long hiring cycles. No wasted time. Just fast, high-quality talent when you need it most.

Spend $1,000, get $500 back in Upwork credit — but act fast, the promo expires 12/31/2025. Finish 2025 smarter with:

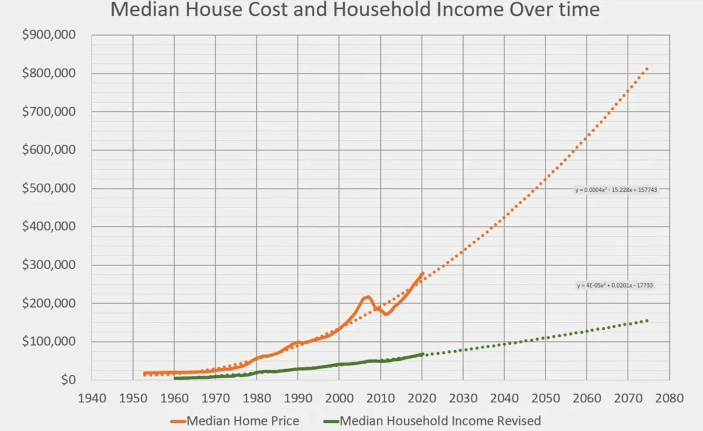

If you time-traveled to 1950, you could buy a home for 3x your annual salary.

Today, a starter home costs 11x. Why?

The easy answer is “Corporate Greed.” Everyone wants to blame BlackRock. It’s the perfect villain: A faceless, trillion-dollar hedge fund buying up single-family homes and pricing out regular Americans. It makes for great tweets and soundbites.

But it’s statistically wrong.

The real answer is that the Starter Home didn’t just get expensive.

We effectively made it illegal to build.

While we are busy fighting a Wall Street war that doesn’t actually exist (I’ll prove it with data below), we are ignoring the silent, structural cost that is actually destroying the American Dream. There is a reason why a “Starter Home” that costs $182,000 to build ends up selling for $372,000. It’s not corporate greed. It’s not immigration.

It is a hidden layer of cost that I call the Bureaucracy Premium.

Today, I’m going to show you exactly where your money is going, why the “1950s Home” is a myth, and the one boring fix that could actually solve the crisis.

The “1950s” Myth

We love to look back at the 1950s as the golden age of housing.

1950s: Median home price was $7,300 ($89,300 adjusted for inflation).

2025: Median home price is $430,000.

On paper, it looks like we’ve been robbed. In 1950, a home cost 3x your salary. Today, it costs 7x (or 11x in California).

But here is the uncomfortable truth: We aren’t buying the same product.

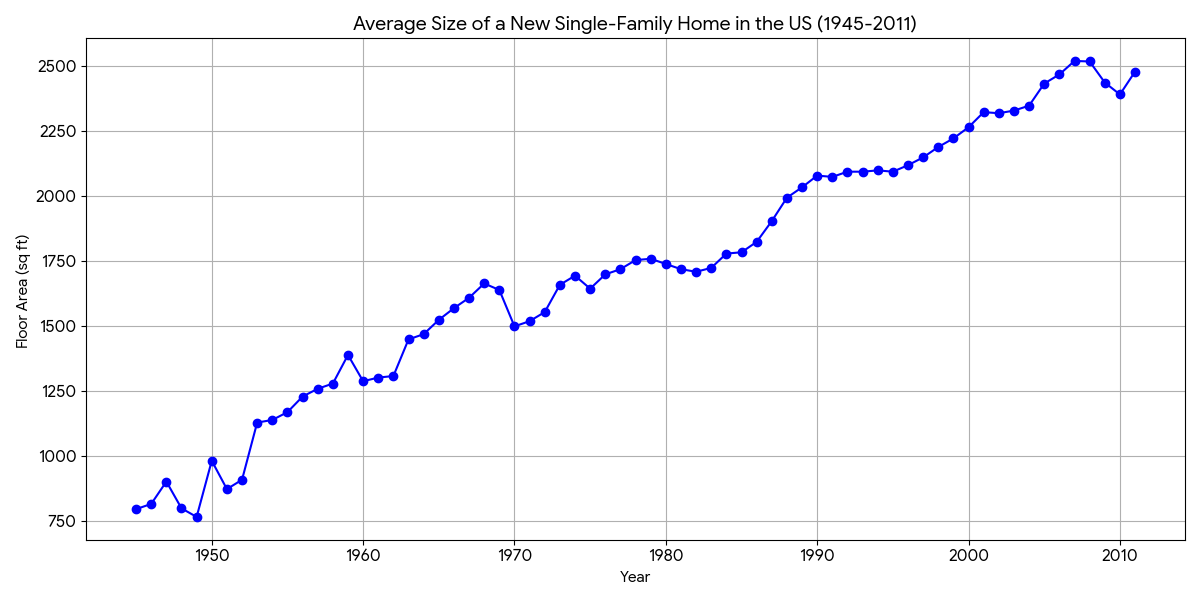

In 1950, the average new home was 983 square feet. It was a plywood box with no AC, 1 bathroom, and 2 tiny bedrooms. Today, the “standard” starter home is over 2,700 square feet.

We demand 2-car garages, energy-efficient windows, and multiple bathrooms. What was considered a luxury has slowly become a necessity. That isn’t necessarily a bad thing – but it means that the minimum expectations kept rising. We didn’t just get poorer, our tastes got expensive.

In the 1980s, 40% of homes built were “entry-level.” Today, only 9% fall into that category. But even if we stripped away the granite countertops, homes would still be unaffordable. Why? Because of what I call the “Ghost Tax.”

I break down the hidden mechanics of real estate every Monday. Join 39,000+ investors who see the story before the news reports it:

The $56,000 Signature

The National Association of Home Builders estimates that regulatory compliance accounts for nearly 25% of the price of a new single-family home.

This isn’t about safety. It’s about friction.

In Minneapolis, for example, building a home in the affordable $150k–$250k range is mathematically impossible. One analysis showed that a house costing $182,000 in materials and labor ends up with a final price tag of $372,000.

Where did the extra money go? $56,000 went purely to government fees and administrative costs. That is a $56,000 check you write for nothing. No brick, no wood, no labor. Just permission.

My Personal $20,000 “Tree Tax”

To give you a concrete example, let me share my recent experience adding a unit in Los Angeles. I spent over $200,000 building a modest 720-square-foot unit. I paid $10,000 in city permits. I incurred another $20,000 in costs to fix a sewer line connection. But the real problem came in the form of a tree.

To fix the sewer, I needed a permit to prune the root of a tree.

But the tree was diseased, so I needed a separate permit to remove it.

But to remove it, I needed a third permit to plant a replacement.

This is the bureaucracy premium. Every week of delay adds interest costs to the builder, which gets passed directly to you, the buyer.

Have you ever hit a wall of red tape during a renovation? Share your horror story in the comments.

Why “Wall Street” is a Distraction

So if regulations are the fire, why is everyone blaming Wall Street smoke? Because of viral misinformation.

You may have seen a tweet claiming that “BlackRock is paying 20-50% above asking price” to outbid families and buy entire neighborhoods. (The tweet was deleted, but the archived version is here)

Let’s look at the facts of that specific case:

The neighborhood in question was purpose-built for renting by a developer (D.R. Horton).

It was sold as a bulk package of 124 homes.

Individual families were never bidding on these homes. Wall Street didn’t “steal” them from you. They bought a rental product that was never for sale to the public.

But what about the rest of the market? Headlines scream that investors bought “1 in 4 homes” last year. That sounds terrifying – until you check who those investors are. Out of those “institutional investors”:

50% are “Mom-and-Pop” landlords (people owning fewer than 9 properties).

11% are Mega-Corporations (owning 1,000+ units).

That means, if you bought your first rental property, you would be counted as an institutional investor. When you do the math, mega-corporations account for only 2.8% of all purchases. Private equity firms own roughly 1.6% of all rental homes in the US.

If you look at the total U.S. housing market (roughly 86 million single-family homes), institutional investors own approximately 574,000 homes. If we banished every single hedge fund from the market tomorrow, it would increase the available housing supply by less than 1%. It wouldn’t even make a dent in prices.

The Boring Solution

The uncomfortable truth is that you aren’t losing bidding wars to BlackRock. You are losing them to a system that has made it illegal to build enough homes for the people who need them. If we want cheaper homes, we have to make it cheaper to build them.

Streamline Approvals: Reducing the time it takes to get permits (e.g., a “one-stop-shop” system) would lower the carrying costs for builders, which lowers the price for buyers.

Review Fee Structures: High administrative fees often discourage legal work. Lowering them could encourage more compliant development.

Embrace Modular Housing: Cities like Austin, TX, have seen rents drop by 22% by removing outdated parking requirements and allowing denser, simpler housing.

Incentivize Supply: Tax abatements for builders who deliver affordable inventory can make the numbers work again.

We don’t need a revolution. We just need to cut the red tape.

If you agree that we need to modernize how we build housing, hit the Like button. You can also share this post by Restacking on Substack or sharing the link on Twitter so your friends can see it.

I’ll be tracking every change in the housing market, so stay subscribed to get it in your inbox:

And don’t forget to check out our sponsor!

Really appreciate the breakdown here — regulatory friction absolutely raises the cost of new construction. But there’s still a gap this explanation doesn’t fully close.

Permitting delays and impact fees make new homes more expensive.

But they don’t explain why existing homes doubled or tripled in price in markets with no new construction at all.

What changed after 2000 wasn’t just supply…it was the financing.

HELOC-to-down-payment loops

DSCR loans based on projected rent

Cross-collateralization

Investors using leverage to buy 3–5 homes while families try to buy one

Leverage went vertical, and prices detached from wages.

Regulatory reform matters — but without addressing the way credit fuels demand, the underlying pressure stays the same.

I think both sides of the equation matter, but the demand-side leverage story is a big part of why this decade looked so different from the 1950s–1990s.

So frustrating! The same thing is happening with vehicles. You can't build a car without computers, camera, bells and whistles. It's illegal. So the prices are crazy. Our government is way too bloated.