How to Identify Opportunities

We all want to shape the world for the better, and we know some roles offer much greater opportunity to do this than others — the important question is, how do we identify these jobs?

80,000 Hours is a nonprofit that aims to help people find a fulfilling career that does good. They’ve conducted over 10 years of research into what makes for a high-impact career. All that research is available on their site, plus a podcast, a job board with open job opportunities, and free 1-1 calls with their impartial advisors.

Everything they provide is free, forever — their only aim is to help people find more fulfilling careers that do good.

Get a free copy of their career guide at http://80000hours.org/grahamstephan

It’s done. The One Big Beautiful Bill has passed the Senate and will be made into law. For the last few months, this bill has been the center of so much discussion and controversy – even causing rifts between the president and his most powerful allies like Elon Musk. It’s going to touch almost every area of your life if you make any money at all: income taxes, healthcare, auto loans, mortgages, tips, overtime, social security, your children’s future savings. Even gambling losses.

There are a lot of open clauses and secret loopholes in this bill that are going to save you a lot of money if you know how to spot them. At the same time, critics of the bill think that it’s one of the most destructive bills for the US economy in the long term. I’ll tell you exactly how you can save money now that this bill is going into effect while also covering both sides of the issue.

Let’s get started.

Corporate tax, tips, and overtime

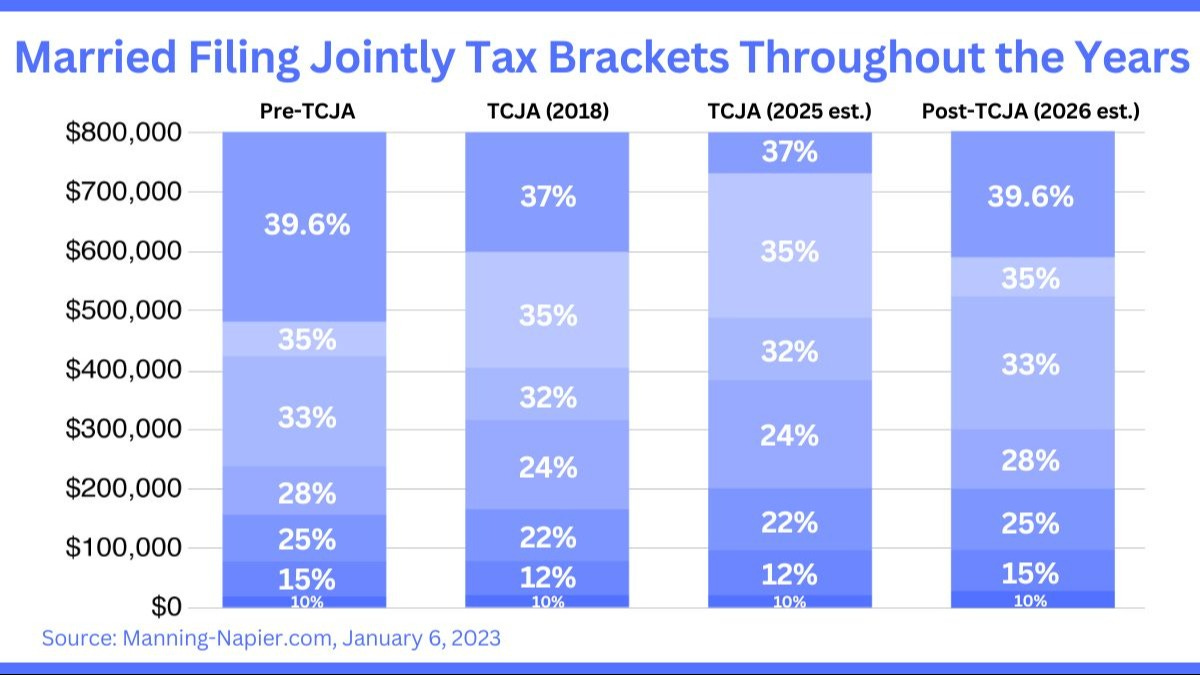

In 2017, Donald Trump passed the “Tax Cuts and Jobs Act” which lowered taxes for people across the board, bringing down corporate income taxes from 35% down to 21%. For anyone who was self-employed, this allowed some substantial write-offs. These writeoffs were time-bound though – they were set to expire in 2025 if nothing was done, except, something was done. The brand new tax plan keeps the tax brackets unchanged from 12% to 37% as they were in 2018, and will increase slightly starting in 2029. The 39.6% tax bracket has been removed, and after-tax income for nearly all Americans will be slightly higher.

Apart from this, one of the most popular items is: No tax on tips. This was a huge part of the campaign promise, and it got pushed through. Except, there were a few slight variations –

only applicable from 2025 through 2028 (might not last after that)

up to a maximum of $25,000 in tips

only to people who work in traditionally tipped industries like restaurants, hospitality, bartenders, taxi services, etc. (even if you get a W2 paycheck)

including both cash and credit card transactions

as long as your income is below $150,000 (single) or $300,000 (married)

Similarly, there’s another class that lets you pay no income tax on overtime pay. If you work more than 40 hours a week you can deduct the overtime pay from your taxable income to make it “tax free.” Again, this benefit is only for those who earn below $150,000 per year (single) or $300,000 (married).

The overtime clause comes with some caveats though. It can be easily gamed, especially if you’re self-employed, so employers will have to report overtime pay separately to the IRS so they can verify the deduction. But if you qualify, this clause could save you a few thousand dollars. (Social security and Medicare Payroll Taxes will still apply to tips and overtime wages. It’s not totally tax-free).

Critics say that only 8% of hourly workers and 4% of salaried workers receive overtime pay, so this only applies to a small subset of people, mostly in the hospitality industry. But hey, if that’s you, then you save a bunch of money.

The loophole most people miss

Prior to the 2017 Tax Cuts and Jobs Act, you could completely write off state and local taxes from your Federal taxes. If you lived in California and paid $30,000 in state income taxes and $20,000 in property taxes, that $50,000 was deductible from your Federal taxes. But since 2018, the deductions were capped at $10,000 regardless of your state, whether you were married or single, and without adjusting for inflation.

If you lived in California, New Jersey, or New York, you ended up paying way more than before.

But starting in 2025, the SALT deduction has been quadrupled to $40,000 – increasing with inflation every year thereafter – for all filing statuses (single or married). However, for high income earners earning more than $500,000, this cap will be slowly phased till it hits the $10,000 cap from earlier. This plan is valid till 2029.

But here’s a loophole that most people don’t know about that could save them tens of thousands of dollars. It’s called The SALT Cap workaround.

Instead of an S-Corp owner paying themselves the full distribution and paying state taxes on a personal level, the S-Corp can pay its portion of state taxes as a deduction – which is not limited by the $10,000 or $40,000 SALT Cap. Then, that credit will transfer to you on the individual level. This essentially allows you to use the full amount you pay in State and Local Taxes as a write-off.

Don’t believe me?

So far, 30 states have already approved this strategy, and the IRS even issued guidance on how to proceed with it. The Senate was even considering language on how to close this loophole, but they didn’t insert it. Obviously, this is something you need to check with a professional before going ahead, but hopefully you learned something new.

More ways to save money

Apart from these, the bill offers a number of ways to save money:

The mortgage interest deduction: This lets you deduct up to $750,000 on a primary residence against your income when you pay taxes. If you have a mortgage of that size and pay 6% interest, that $45,000 could be potentially written off if you itemize your deductions. On top of that, even mortgage insurance premiums could be eligible for deduction.

Bonus depreciation is back: This is the largest tax write-off for high income earners. If you fall in the right industry, this could save you a lot of money. In 2018, Trump made it possible for business owners to deduct 100% of the cost of qualifying expenses like heavy machinery, in its first year. This gives a massive upfront tax break. Earlier, these were supposed to be phased out by 2027 – but the new bill makes these deductions possible indefinitely. Business-use cars that weight 6000 pounds or more, and planes, can be 100% write-offs. Some real estate expense can also be bonus depreciated against income in their first year.

An increased Standard Deduction: Standard deduction has been raised to $15,750 for single filers, and $31,500 for married people filing jointly, effective in 2025. Even if you don’t qualify for any other write-offs, this saves you an immediate amount right off the top.

The 20% Qualified Business Expense: Eligible entities like S-Corps can take a 20% deduction from their top-line revenue. This has now been made permanent, giving those who qualify an immediate and indefinite 20% tax break.

The 1099 Reporting Threshold: Previously, if you paid a freelancer more than $600 for services rendered, you’d have to get their tax info and report a 1099. Now that threshold has been raised to $2000, saving you a lot of paperwork on hiring people for small tasks.

A lot of these are extensions or increases on existing tax breaks. But here’s something in the bill we’ve never seen before:

Deductions on personal car loans

Last week I wrote about the car bubble in the US. The average car payment in the US is $742 per month now, at an average interest rate of 6.35%, with an average loan size of $41,572. The interest that you pay on your loan isn’t something you can deduct from your taxes – at least, it used to be that way. But now you can.

Starting this year, through 2028, you could deduct interest payments on personal use vehicles, up to $10,000 per year – on top of the standard deduction. The condition is that the vehicles have to be made in the USA. This deduction starts to phase out once you start making more than $100,000 a year, and if you’re making more than $150,000 a year (single) or $300,000 a year (married), you won’t benefit out of this.

But if you’re planning to buy American-made cars anyway, this gives you an additional write-off. My only worry is that people might start to take larger loans just because the interest is a “write-off,” and my suggestion is to be cautious.

The downside to this bill is that it’s eliminating the $7,500 clean vehicle tax credit from September 30th this year. So if you’re planning to get a tax credit on your EV, now’s the time.

Old and young

The original plan was to remove taxes on social security altogether. That turned out to be too difficult to implement, so they raised the standard deduction by $6,000 for those over 65, through 2028. It phases out once individuals earn more than $150,000 per year. This could shield some or all of a person’s social security income from taxes. Some will get a big benefit depending on how much they make, while others will get nothing (because a lot of social security income isn’t taxed to begin with).

Then there’s the $1,000 Trump account. With this, eligible children born between 2025 to 2028 will get a $1,000 one-time tax credit into an account that could be invested. Parents could also contribute up to $5,000 per year for those under 18, giving their children a huge head start. With compound interest, that money could grow into something much bigger and could be used later in life for higher education, startup costs, etc. Non-qualifying expenses (like Coachella) would get a 10% penalty plus taxes, and if left unused, the account would automatically cash out at the age of 31.

There’s also one more weird clause that I don’t know where to put: People who lose money gambling will be able to write off only 90% of their losses. So if you lose $1000 and win back $1000, you’ll have to pay a tax on $100 even though you’ve made no money. It makes no sense to me, and I don’t recommend gambling, but it’s something to be aware of.

The dark side of the bill

Well, those are all the ways you can save money on the bill, but let’s talk for a minute about the impact that these changes will have over the next 10 years. That impact is going to be about $2.9 Trillion – because all that money has to come from somewhere right?

There’s no way around it. This will add to the national debt, by a lot.

Proponents of the bill say that the extra spending will help accelerate growth so much that a little more debt won’t matter. But critics argue that a spending spree of this size is going to hurt future generations – and on top of that, it’s estimated that Federal Tax revenue is going to be reduced by $4.5 Trillion.

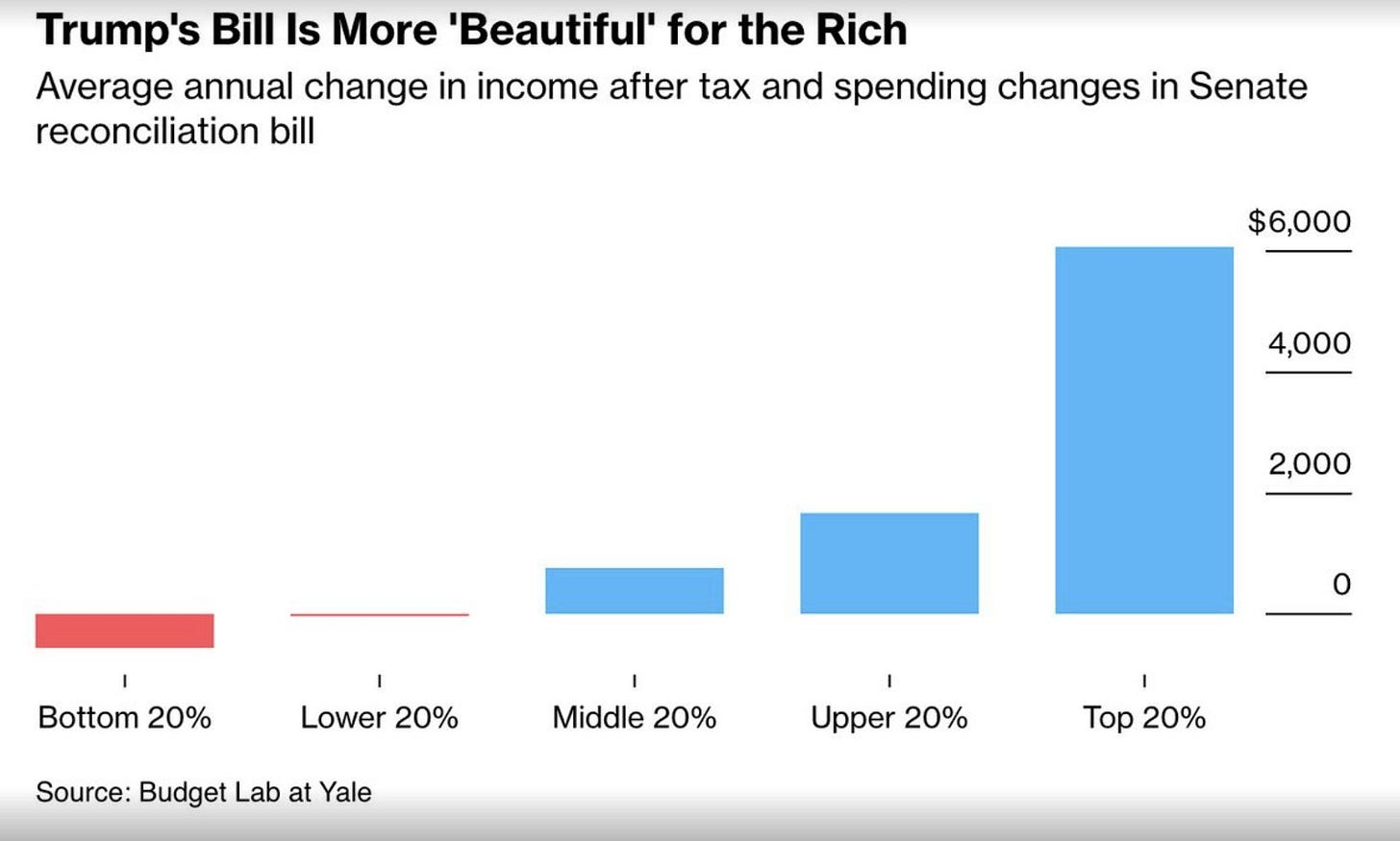

Some people have reported that this tax plan will cost the bottom 20% of taxpayers $560 per year, while the top 20% get a boost of $6,000 per year. Although, considering that the top 50% of taxpayers pay 97% of all income taxes, it makes sense that a bigger tax cut would benefit them more.

There’s also criticism that this bill would reduce Medicaid benefits by mandating work requirements. This might result in people losing coverage. Supporters say that this encourages able-bodied adults to work and cracks down on abuse. Others argue that it hurts low-income and vulnerable families struggling with unstable employment.

On the whole, this is quite a divisive bill.

Some people love the additional spending, some people think it’s not enough.

Some think there aren’t enough cuts. Some think there are too many.

I’ve tried to give you the full picture here, so it’s up to you to make up your mind. I’d love to know what you think in the comments below.

I’ll see you again next week with another article. Don’t forget to check out today’s sponsor!

If you reached the end of the article, just let me know what you thought with “Great | Good | Bad | Terrible” in the comments. Also reply to me with any feedback – I read every reply!

Great insights, Graham! Most people do not highlight both sides of the bill, so I appreciate the pros and cons of the newsletter

Great article Graham.

This is the most overlooked information that many news networks intentionally avoid:

"considering that the top 50% of taxpayers pay 97% of all income taxes, it makes sense that a bigger tax cut would benefit them more."