What’s up Graham, it’s guys here :-) If you want to join 24,949+ smart investors and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

In many ways, 2020 & 2021 would be defining years for financial markets for quite some time. The Federal Reserve printed more than $3 Trillion as part of pandemic relief just in 2020. To put it in some context, that’s more than 1/5th of all the U.S dollars in circulation. The effects were instantaneous - Even with the multi-month-long lockdowns and the COVID crash, the S&P 500 ended up gaining 16% in 2020. It went on to add another 27% in 2021. In fact, the S&P 500 notched 70 all-time highs in 2021, a record that’s second only to 1995. Bitcoin touched its all-time high of $69K and people were shelling out six figures for NFT rocks.

But, what hit everyone by surprise (even the Fed) was how fast inflation would rise. The cost of renting went up by 10% in 2021, 5x the rate in 2020, and 3x the normal rate. The used car market went supernova in 2021 with prices increasing by a whopping 40% from Jan ’21 to Jan ’22.

The tide is changing now.

Used Car Prices are Falling

The latest report from BlackBook just found that prices of sub-compact cars have declined 3.6% in just the last week. The situation is getting so bad that lenders are even warning prospective buyers that their car loans could soon be underwater.

I highlighted the warning signs way back in July and we are starting to see the worst-case scenario.

It’s high time we talk about the current state of the auto industry, the latest data that was just released, and how much prices could fall over these next few months.

Rental Market Downturn

It’s official now - After a decade of unstoppable growth, rental prices have begun to fall. Recent data shows that, in the third quarter of 2022, national asking rents declined by 0.4%, and Rent.com reported that their data showed a month-over-month decline of 2.48%.

The cherry on top of this news is that congress is introducing a new bill called the Stop Wall Street Landlords Act of 2022. The idea is to prevent large corporations from buying single-family homes and then jacking up the rent prices. The bill is expected to prevent businesses and owners having more than $100M in assets from claiming depreciation and interest expense on their properties.

So, in terms of the latest data about where prices are increasing and decreasing the most, along with what you can do about it, here’s what you need to know:

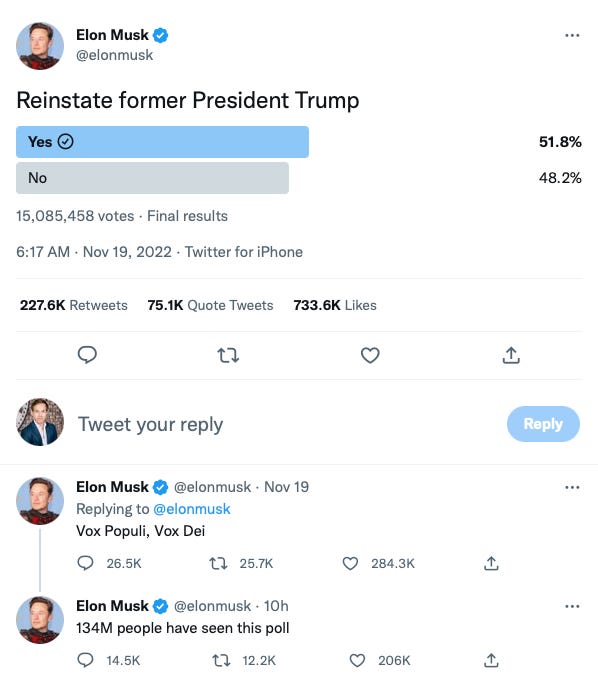

In other news, I have been obsessed with what’s going on at Twitter and constantly refreshing my feed! It’s like the Wild West of social media, and just yesterday Elon Musk decided to reinstate former President Trump on the platform after his poll racked up more than 15 Million votes.

See you next week with another bunch of exciting videos!

And force of habit - Smash that like button to help others find this newsletter. Hit that subscribe button if you haven’t done so already!

What's that Charlie Munger? Something about a mental model...oh yeah, the Law of Compensation.

My car lease is up in January. I’m a little wary about the next right move.