What’s up Graham, it’s guys here :-) If it’s your first time here, hit the subscribe button below to join 40,000+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

Let me tell you the story of Ronald Read.

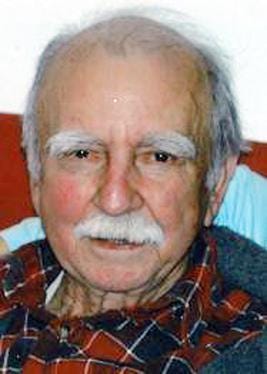

Ronald Read was the last person anyone expected to be rich. He grew up on a farm in Vermont, worked at a gas station for decades, and later took a job as a janitor at J.C. Penney. He drove a used Toyota, chopped his own firewood, and wore the same flannel shirt for years, occasionally treating himself to a muffin at a local cafe. To the people in his small town, he looked like an ordinary, hardworking middle-class man.

That’s why, when he passed away in 2014, the news shocked everyone: Ronald left behind an $8 million fortune. He hadn’t won the lottery, started a business, or made a lucky gamble. Instead, he had quietly bought blue-chip, dividend-paying stocks, avoided trends he didn’t understand, and simply let compounding work for six decades.

In his will, Ronald gave nearly $6 million to his local library and hospital, with the rest going to family who had no idea about his investments. A man who spent his life sweeping floors and pumping gas ended up transforming his entire community not through a windfall, but because he mastered the basics of patience and frugality.

I find that story inspiring. If someone living on a janitor’s salary could quietly build that kind of wealth, then surely there’s a method to the madness of not spending.

Learning how expensive life really is

I’ve always been frugal – maybe a bit too frugal. Some people call it thrifty, others say financially conservative. I just call it what it is: not spending money.

Even now, I try to live only on the income from my investments and save the rest. That means no guacamole at Chipotle. It means waiting until nine o’clock for the happy hour sushi price (which I still do, no kidding). It means grabbing the generic cereal instead of the brand name because it’s literally the same thing, two dollars cheaper.

Outside of a few intentional purchases I’ll explain later, I don’t really buy much: No designer clothes or first-class flights (unless it’s free with points). I still drive the same 2019 Tesla Model 3 that costs me seventy-eight bucks a month. To most people that sounds ridiculous, but there’s a method to the madness.

I developed this mindset starting in high school. I picked up a part-time photography job for a reef aquarium company and made about a hundred to two hundred dollars a week. At sixteen, that felt like real money… until I looked at how quickly it vanished.

Groceries: $100 gone.

Car insurance: $150 gone.

Cell phone: $50 gone.

Dinner out: $40 gone.

Suddenly I realized a single meal cost me two hours of my life, at twenty dollars an hour. And the big stuff? Forget it. A hundred-thousand-dollar car would have taken me ten years of saving every penny. A two-million-dollar house? Closer to forty years. I once saw a customer wearing a ten-thousand-dollar Rolex and I went… WHAT?!! That watch was worth more than an entire year of my income at the time.

It was at that point I realized something important: the only way forward was learning how to not spend.

Speaking of saving, if you’re looking to save even more on expenses, one of the easiest wins is your phone bill. That’s why I like Helium Mobile – a new carrier with plans that can actually pay you to use them. Their free plan gives you 3 GB of data, 100 minutes of voice, and 300 texts with no credit card required, in exchange for sharing anonymized location data that’s only used to improve coverage. They also offer an unlimited option for $30 a month, plus a $5 Sprouts plan for kids with parental controls. On top of that, you can earn Cloud Points for referrals or data sharing and redeem them for gift cards at places like Amazon or Apple. Sign up with code GRAHAM to get $10 in Cloud Points and start cutting that monthly bill right away.

Seeing behind the curtain

When I got my real estate license at eighteen, I drove forty-five minutes every morning to Beverly Hills because I wanted to be in the most expensive market I could find. If I was going to sell real estate, I wanted to learn from the people buying it.

Pretty quickly, that world started to feel… normal.

Clients bought five-million-dollar homes in cash like it was nothing. Bentleys rolled through town like Honda Civics. I remember watching someone at Saks drop fifty-five thousand dollars at the register in one shot. To me, it felt like stepping behind the curtain in The Wizard of Oz. I hadn’t grown up around any of this, so seeing it up close was like discovering a new planet:

The surprising part was that these people weren’t superhuman. They weren’t more talented or harder-working than I was. They were just regular people who happened to build wealth and to them, it wasn’t even a big deal. That realization flipped a switch in my brain. If they could do it, then why couldn’t I?

Fast forward almost twenty years and, yes, I could be buying new Bentleys and blowing fifty grand on a random Tuesday. But the truth is, my psychology hasn’t really changed. Early on, I also learned a concept that completely reframed how I see money: I only earn what my money earns me.

So if I make $10,000, I don’t think of it as ten grand to spend. I think of it as about thirty dollars per month, forever, adjusted for inflation. That’s an income stream, not a lump sum. To be conservative, I use a spend rate of 2.75% per year. For every $100,000 invested, I allow myself $2,750 of passive income, without ever touching the principal. Suddenly, $100,000 looks less like a windfall and more like a modest annual paycheck. That mental shift is why I’ve kept my spending low, based only on what my investments generate, not on my salary.

At the end of the day, money is just about options. The option to do work you enjoy. The option to sleep in. The option to spend your time the way you want.

And here’s the twist: once you reach the point where you can afford almost anything you want, the desire to actually buy it fades. The thrill of a Gucci shopping spree isn’t the purchase – it’s the freedom to know you could if you wanted to.

The Dollar-to-Fun Ratio

When it comes to spending, I use a system I call the Dollar-to-Fun Ratio. It sounds a bit silly, but here’s how it works: take the amount of enjoyment you get from something, divide it by the cost, and that gives you the value per dollar spent. For example, I found an amazing all-you-can-eat sushi spot in Vegas for $30. On my personal fun scale, that’s a 90 out of 100. Divide 90 by 30, and you get a ratio of 3. That’s great value.

Now compare that to a two-hundred-dollar wine tasting. For me, that’s maybe a 20 on the fun scale. Divide that by 200 and the ratio drops to 0.1. Sushi night wins every time.

The same goes for my hobbies. I can spend hours tinkering with my reef aquarium, which costs me maybe a hundred dollars a month. That’s a fantastic dollar-to-fun ratio because I get so much enjoyment out of it.

Of course, some people will say: “But Graham, you have a multi-million-dollar house, a Ford GT, and Rolex watches. Isn’t that hypocritical?”

Yeah yeah, you have a point there, but here’s the truth: most people buy those things the wrong way. They overpay for a house they can’t afford. They buy cars that collapse in value the moment they buy them. They chase hyped-up watches at twice the retail price because some celebrity liked them. This is a waste of money. But if you plan your purchases strategically, you can own almost anything you want for free.

Take my house, for example. I ran the numbers before buying. Just from leaving California, the savings alone paid for the new house in full. I borrowed at a 2.875% rate and, over five years, my initial down payment has returned about 700%. Add in the tax savings, and the house has more than paid for itself.

I bought the Ford GT four years ago, expecting it to at least hold value. Instead, it’s gone up almost 50%! That’s not just a car, it’s a profitable investment.

It’s the same with my Rolex. Years after having my mind blown by a $10,000 Rolex, I bought a 1980s gold Oysterquartz for $12,500. Fewer than five thousand of these were ever made, they’ve been discontinued, and the gold that the watch is made of (if you melted it down for scrap) is itself worth more than what I paid. That’s not a splurge – it’s a free watch. I did something similar with the Daytona. Instead of fighting to buy the new “Panda Daytona” at retail, I tracked down a 1998 Zenith Daytona with its original box and papers for the same price. They stopped making them twenty-five years ago. Again, a watch I could easily resell for at least what I paid.

This isn’t limited to million-dollar houses and rare watches. Anyone can do it. Buy the version of what you want that holds its value. A Honda S2000 might end up cheaper to own than a Corolla. A used Tissot PRX can be resold for the same price you paid. A lightly used MacBook Pro, bought at a discount, might cost you nothing over a year if you negotiate well. Facebook Marketplace is full of these kinds of deals.

The point is simple: with a little effort, you can often get what you want for free. And even with travel, you can book first-class flights and luxury hotels by redeeming points, without spending anything extra out of pocket.

Why the basics win

That’s why, when I do spend money, I make sure I won’t lose it. I’ve followed this rule for years. It’s how I bought a Lotus Elise for $30,000, drove it for two years, and sold it for $30,000. Same story with my Lotus Exige S240.

Every house I’ve owned has made me money while I lived there. With a little patience, almost anything can be “free” if you buy it right.

So if you see me with something expensive, just know I probably found a way to get it for free, or close to it. Except the Tesla Roadster. Let’s just pretend that doesn’t exist. (You can read about it in my million dollar mistakes article)

Here’s the bigger point: the basics usually give you most of the joy. Beyond a certain point, the dollar-to-fun ratio drops off fast. You might get 90% of your happiness from the first $25,000 of discretionary spending. Chasing the last 10% can cost millions. A guy in a Rolls-Royce isn’t having that much more fun than someone in a paid-off Mazda Miata with the top down. A first-class seat isn’t that much better than economy with extra legroom.

Here’s my final takeaway: Be intentional. Invest early, let your money compound, and when you do buy, focus on things that hold their value. And if you want to earn more, surround yourself with people who make the money you want to make. You don’t need to relocate or commute to Beverly Hills to do this: follow smart people online, read what they read, and learn how they think. Eventually, that mindset starts to sink in.

At the end of the day, this isn’t about being cheap. It’s about building a life where money gives you choices. Whether that’s saving for a dream car, enjoying thirty-dollar sushi, or just sleeping in without worrying about bills, the freedom comes from intentional decisions.

You don’t need to spend a fortune to live a rich life. You just need to make smart moves, stay consistent, and let the small habits stack up. If I could do it, starting with a hundred bucks a week and refusing to pay extra for guac, you can too.

If you read this far, let me know what you thought by commenting: Great | Good | Meh | Terrible at the bottom. I read every single comment and email reply.

I’ll see you next week!

An internship I had in college paid so little, that I calculated the first 2 hours a day working was just to pay off the price of the train tickets to get to work!!

I also adopted the hours worked to purchase something mentality as well.

Next hardest thing is raising my kids to hopefully have a similar mindset.

Dollar-to-Fun Ratio is a great gutcheck. I do the same thing with clothes but call it "cost per use" - if you have a jacket that's $200 but you're going to be wearing like every day in a season, that's way better money spent than a $50 shirt that you'll only wear once.

Graham, what are your thoughts and approach on spending on education like courses, seminars, etc as an investment?