What’s up guys, it’s Graham here :-) If it’s your first time here, hit the subscribe button below to join 40,000+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

Reading time: 5 minutes

Let’s get right to it: Despite mounting pressure from Donald Trump to lower rates, the Federal Reserve Chair Jerome Powell has decided to keep rates unchanged – in the middle of one of the most volatile markets I’ve ever seen. While the stock market is hovering near all-time highs amidst conflicts with the Middle East, the bond market is imploding with losses we haven’t seen since the 1970s. And while all this is going on, billionaire investor Ray Dalio is sounding the alarm bells about growing national debt calling for immediate action.

This moment is critical. We need to understand what Powell just said, why bonds are collapsing, whether it’s too late to buy stocks, and what it all means for everyday investors.

Why aren’t rates being slashed?

It comes down to three letters: CPI.

The Consumer Price Index (CPI) is the go-to measure for inflation. It tracks the increase or decrease in prices over the last month and year.

As of now, it was found that prices were rising just 0.1% month-over-month, putting the annual inflation rate at just 2.4%. Most of the decrease came from energy prices which slipped 1%, and most of the increase came from housing which is still up 3.9%, the lowest since 2021. That’s good news… right?

But there’s a theory that much of the recent pricing lull may be artificial, driven by businesses pre-purchasing inventory, or a lag in increases due to tariffs not making it to the CPI data. Core CPI hasn’t budged in the last few months. But inflation is only part of the picture.

The real warning sign is in the Bond Market.

Bonds in Freefall

Bonds are supposed to be the safest part of your portfolio, because you are lending money to the US government, which has never defaulted. But bond prices are now down by as much as 46% while interest rates are rising, with losses we haven’t seen in 250 years. Why?

When interest rates rise, old bonds become less valuable. Why buy a bond that pays 2% when you can get one that pays 5%? So bond prices have to fall to entice investors to buy. This is affecting three major areas:

Banks are holding bonds issued at historically low rates – and their unrealized losses have frozen their deposits. This mismatch was the reason for Silicon Valley Bank’s collapse (I wrote about the collapse here).

The US Government’s debt is reaching unsustainable levels. To attract buyers for this debt, the government is offering higher yields on 10- and 30-year bonds. But this creates a vicious cycle – this increases the interest that the government has to pay on its bonds while increasing investor skepticism around reliability of the US.

The dollar is spiraling. As debt grows, rates rise making borrowing harder. The only way out eventually is to print more money, which devalues the dollar further.

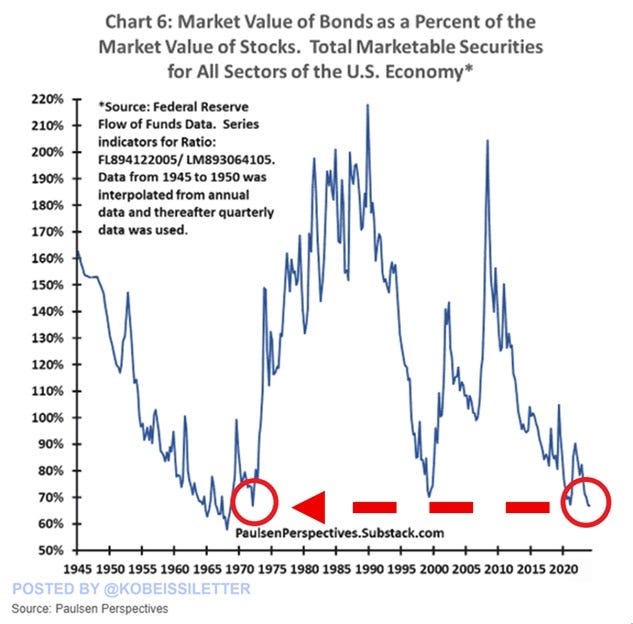

The value of bonds have fallen to 50% of the stock market.

And yet, some see opportunity: With yields at 4.5%–5%, bonds are offering returns we haven’t seen in decades. But there’s one more reason the Fed is hesitant to commit on rate cuts:

Tariffs.

Amidst weak job growth, Trump is urging the Fed to cut rates and boost the job market. But Powell is cautious because tariffs are still a wild card. If tariffs stay elevated, we could see inflation, slow growth, and rising unemployment.

If the Fed cuts rates too early, they risk playing their card too early instead of using it when the economy needs stimulation. The Fed’s credibility is important to the market.

It’s not all gloomy though. Talks with China, Japan and Mexico are hinting at signs of relief. But ultimately, the Fed has to choose – to fight inflation or to support growth. One alarming stat is that 25% of Americans are “functionally unemployed,” i.e they work in poverty wages, don’t have a full-time job, or want a job but don’t have one.

Looking at history though, this is one of lowest figures in the last 30 years, and we don’t need to worry.

Stocks: Bull Run or Bubble?

One anomaly is that despite all this turmoil, stocks have had an amazing run over the last decade. The question is whether this rally can continue or if it’s a bubble.

Here’s the bear case:

38% of S&P 500 companies issued negative guidance. Just 15% issued positive guidance. This is the worst ratio since 2008. (Cresset Capital)

GDP shrank by 0.3% in Q1, and stocks could follow if it continues. (RSM)

The volatility due to tariffs could spook markets.

Stocks are expensive right now. They’re trading at 20 times earnings, which is historically high. (Ameriprise)

But here’s the bull case:

Inflation is easing. It’s going to take a while for inflation to normalize according to the Fed, but by 2027, they expect to hit their 2% target.

Corporate earnings remain strong despite the chaos.

$7 trillion in investor cash is still waiting to deploy, on the sidelines. (Yahoo)

Historically, when the market gains 20% in 2 months, it tends to gain another 30% in the next twelve months (Shout-out to Ryan Detrick!)

Timing the market is a fool’s errand. Dollar-cost averaging still has the best chance of winning in the long run. (A Wealth of Common Sense)

Even investing at all-time highs is shown to be profitable, and you’re more likely to see even higher highs investing at all-time highs.

My Take

Personally? I expect maybe one 25 basis-point cut this year by September at the earliest, and a maximum of two. And maybe only one next year. But I wouldn’t bet on it. Taking all this into account, the Fed’s forecast for the Federal Funds rate is 3.4% in 2027. But how will the economy perform in the meantime?

Ray Dalio put it bluntly: the U.S. has three options to stabilize the economy:

Raise taxes

Cut government spending

Lower rates to reduce debt servicing costs.

What’s more, he says that all three need to happen at the same time. Could this be done? Absolutely. Will it be done? I doubt it. The most likely outcome is that we continue to print money and push the problem to future generations. But objectively, I don’t think there’s going to be any meaningful change or that we should bet against the US anytime soon.

That’s why I’ve opted for long-term diversification so that I have the best chance of winning in the long run. My portfolio has:

35% in stocks (80% U.S., 20% international)

30% in real estate

20% in Treasuries

10% in Bitcoin ETFs

5% in uncorrelated alternatives

My priority is not about maximizing the returns on every dollar. It’s about sleeping well at night and being ready for whatever happens.

If you reached the end of the article, just let me know what you thought with “Great | Good | Bad | Terrible” in the comments. Also reply to me with any feedback – I read every reply!

Great

Diversifying is usually the best but even that isn't simple today bc everyone has their own circumstances.