What’s up Graham, it’s guys here :-) Nearly 2,000 new members joined us in the last three days. If it’s your first time here, hit the subscribe button below to join 36,300+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

Last week, we got a live look at Silicon Valley Bank going down. Since then, Signature Bank NY has also closed down. Two of the three largest bank failures in US history happened within the span of three days. Why did this happen? Let me explain with a thought experiment: The Prisoner’s Dilemma.

Two members of a criminal gang are imprisoned. They have no way of communicating. While they are awaiting sentencing, the authorities talk to each one separately and give them a deal:

If both prisoners stay silent, they each get two years in prison.

If one prisoner stays silent while the other rats on him, the rat walks away free while the other one has to spend ten years in prison.

If both prisoners rat on each other, they each get five years in prison.

The prisoners know their options fully, and at first, they think “If we both stay silent, we just get two years in prison.” But then the fear starts creeping in that the other person would turn them in – after all the reward is freedom. And if that’s the case, staying silent would guarantee 10 years in prison. So finally, the worst solution – turning each other in – becomes the most likely situation, and both prisoners go to prison for 5 years.

The prisoner’s dilemma breaks down because there is no communication. But now that we have access to social media and can talk to each other instantly, we must be able to quell panic instantly, right? Unfortunately, that’s not what happened. On the day that Silicon Valley Bank asked “everyone to stay calm” and everyone looked to the influential figures in the VC space for guidance, what they all got was ALL CAPS PANIC (iykyk). SVB had all the funds it needed to back its deposits – but it couldn’t pay all depositors at once.

But depositors were unsure. It was a classic prisoner’s dilemma. If you were the head of a company who thought there was going to be a bank run and you pulled your funds, the downside was minimal if you were wrong. But being right meant that you could save your company. Everyone was looking to the leadership for advice, but it ended in panic. Withdrawal requests for more than $42 Billion were initiated in 24 hours. A couple of days later, a similar bank run was prompted at Signature Bank New York, probably due to its cryptocurrency connections, and the bank collapsed.

How do we come out of a bank run situation? How is contagion stopped? The answer is again, about building trust and faith in our institutions, and about communicating that trust. Ironically, one of the best examples that people were circulating about this on Twitter was this scene from “It’s a Wonderful Life” where communicating clearly in a crisis saves George Bailey’s bank.

And the US treasury might just have pulled off something similar by bailing out SVB.

Unlimited Money

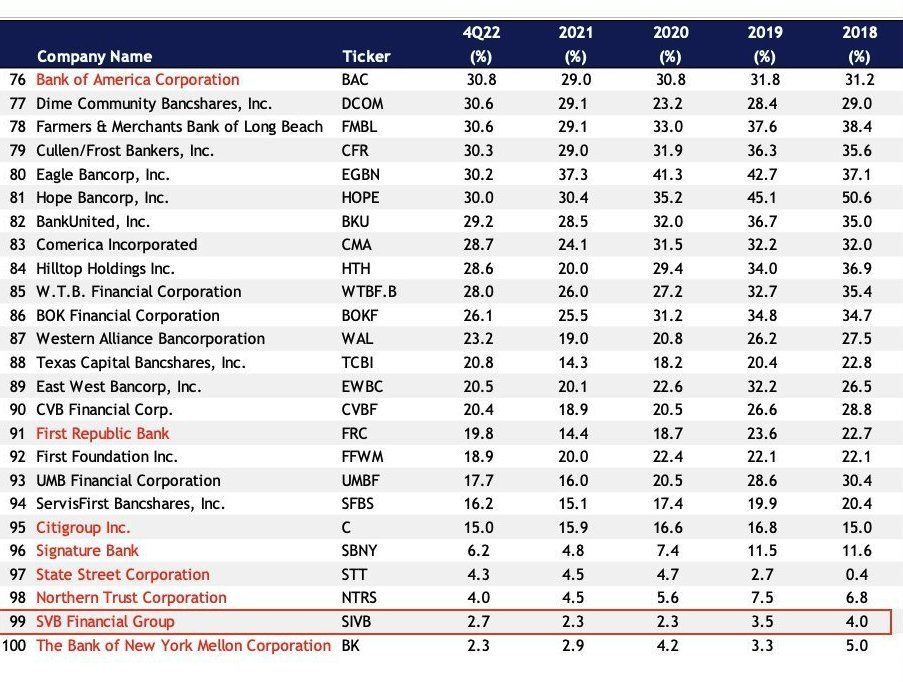

The most important move to save the banking system is to make sure that the depositors still trust banks. Generally, that’s easy for the FDIC to do because it insures accounts of up to $250,000. But SVB’s clients were mostly startups that managed their business accounts, and 97.3% of the accounts were over the FDIC limit. This was also one of the reasons that the panic started in the first place.

Yesterday, Treasury secretary Janet Yellen announced that all depositors of SVB and Signature Bank would be made whole, not just the ones under the insurance limit. In addition, the government has created a program called BTFP (Bank Term Funding Program) that will provide liquidity to banks in case their assets cannot back withdrawals. But this is not a bailout in the sense of free money – the banks would be pledging eligible assets like US treasuries, agency debt, mortgage-backed securities, etc. for a temporary loan that can help them meet withdrawals. The government also expects that this is a worst-case backstop that they would not have to resort to.

Circuit Breaker

Despite these measures, regional bank stocks were in free fall yesterday, with many of them being halted by what is called a “circuit-breaker”. Circuit-breakers (formally “trading curbs”) were first put in place after the infamous Black Monday of 1987, where the stock markets dropped by over 22% in a single day. To prevent this, a mechanism was implemented that would temporarily pause trading for a period of 15 minutes if certain thresholds were met.

Over time, these thresholds have been changed because panic seems to surmount any barrier you can think of. Prior to 2010, the circuit breaker would be triggered by a drop of 10% within 24 hours. This would hopefully give traders enough time to step back and reassess the situation.

But those circuit breakers were tested time and time again.

On May 6th 2010, the Dow Jones dropped 1000 points and lost 9% value in a matter of minutes in what’s known as a flash crash. The SEC changed the threshold from 10% to 7%.

This was also expanded to individual stocks, where trading would be halted if a stock price moved by more than 10% in 5 minutes.

Most recently, the circuit breakers were set off multiple times during the Covid pandemic, and despite their existence, bank stocks took a massive hit in the last few days. Why is this happening?

One reason is that the entire banking system is interconnected to a large extent, and runs in one bank usually create fears about runs elsewhere. And since equity and debt investors could be passed over in the case of a bank failure, they are the first to panic and sell – leading to a reduction in stock price.

No backup plan

A reduction in stock price doesn’t necessarily mean that a bank is in danger, though there is a risk of rating downgrades. However, no bank would be able to withstand a complete run on deposits if their customers chose to move elsewhere – this risk has increased because bank reserve requirements were reduced to zero, as a stimulus measure during the pandemic.

Banks can theoretically invest all of their deposits – though that doesn’t mean that they are throwing everything into AMC Call Options to post a screenshot on WallStreetBets. The funds are usually parked in extremely safe assets, with the tradeoff being that they are illiquid, i.e unless they are willing to sell their assets at a loss. Right now, banks are sitting on $620 billion worth of unrealized losses. With the government’s new BTFP plan enabling banks to borrow funds against their assets, this should give them an alternative – Now the spotlight is on what led to this in the first place: Rate Hikes.

Reverse Gear?

Investors are now blaming the Federal Reserve for raising rates too much, too soon. I don’t envy Jerome Powell his task – I’ve written in the past about how the rate hikes are a Kobayashi Maru test for him – but with the banks failing, there is pressure on the Fed to do the unthinkable: A pause on rate hikes.

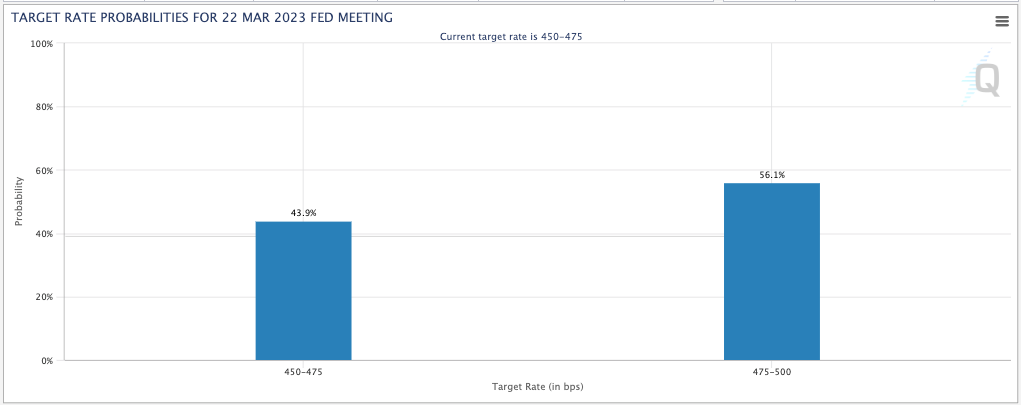

The market is pricing in a 44% chance that the Fed will not raise rates at the next meeting on March 22nd, and a 56% chance of a smaller hike by 25 basis points (it was 22-78 a couple of days ago). Goldman Sachs also backs this view, stating that this would be needed to further calm the markets and put brakes on the fallout. The bond market is reacting to these predictions – Treasury yields have seen their biggest 3-day decline since 1987, as investors are withdrawing money from banks (yikes) to buy bonds, causing their price to increase and yield to fall.

And there’s some good news – mortgage rates are tumbling. But the bad news is that it’s because of downward pressure on the banks. All of this signals that the market believes we could be in for a sudden reversal in interest rates. The Fed may have broken the markets.

But here’s something you might be wondering: What happens if a stock brokerage fails like a bank? What happens to your “buy and hold” equities?

Protecting the custodians

Just like the FDIC insurance covers cash deposits up to $250,000, SIPC insurance covers up to $500,000 per brokerage account, per customer, “for lost or missing assets of cash and or securities from a customer’s accounts held at the institution.” Though they can’t protect your stocks from declining in value, the SIPC will protect you in the event that your shares go missing from a brokerage bankruptcy. There’s an extra layer of security as well – the customer protection rule requires brokerages to keep client assets in a separate account from the firm’s assets to avoid any confusion.

This way, a brokerage can only act as the custodian of those shares. If the brokerage fails, those shares would be transferred to you. If the shares cannot be retrieved or they go missing because of theft or fraud (highly unlikely), the SIPC would step in to cover the balance, up to $500,000. In addition to this, brokerages sometimes use additional insurance to cover higher balances. For example, Charles Schwab has a private insurance agreement with Lloyd’s of London and other English insurers to cover each client account up to $150 Million.

FINRA also seconds this, by saying: “In virtually all cases, when a brokerage firm ceases to operate, customer assets are safe and typically are transferred in an orderly fashion to another registered brokerage firm.” Stocks in a brokerage account are treated the same as contents of a bank’s safety deposit box – if the brokerage goes into trouble, your assets wouldn’t be taken and used to to pay off debts. That should make you feel a little better.

There are a lot of mixed opinions on Silicon Valley Bank’s bailout. Here’s what I think.

The bailout is good in the sense that it reinforces the belief that customers have in the banking system. The system is built on faith, and if that faith is broken, it can spread like wildfire. The Fed has moved fast and decisively to stop this – that’s commendable. It also means that a lot of startups might be saved from extinction that might cascade through the economy.

On the other hand, policy is all about precedent, and this sets a precedent that deposits will always be safe and bailed out, even if they are over the limit. This lets those in positions of power off the hook just a bit, and might encourage recklessness in the future as well. What we need instead is more oversight and higher reserve requirements, so that banks will have more cash on hand.

The main concern was that our system cannot handle an all-out bank run across the country because no bank would have the capacity to return 20% or more of their customers’ money at the exact same time. I think that concern has been solved by the “emergency lending” measures. Personally, I’m not worried – regional bank stocks saw a huge dip but are now bouncing back, but the banking system looks resilient for now due to the Fed’s intervention.

Have we seen the last of this yet? Let me know what you think in the comments.

Stay safe, stay invested, and I’ll see you next week – Graham Stephan.

Hours of effort and research went into making this ten-minute read. If you found it insightful, please help me out by clicking the like button and sharing this article.

Thank you Graham, this was very informative!

With interest rates at historic lows in 2021, it baffles me that banks didn't account for the fact that rates could go up and diminish the value of their bonds/US securities.