Strap In

Wild swings in the market, Ludwig's income, Congress resets investing, and a Dollar crisis

What’s up Graham, it’s guys here :-) If you would like to join more than 21,400 members and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

Do you want to know my favorite part of a rollercoaster ride? It’s when the ride ends. Despite being coaxed into several of them by my friends, I have never really gotten the hang of flying upside down at 55 mph while hanging from a seatbelt.

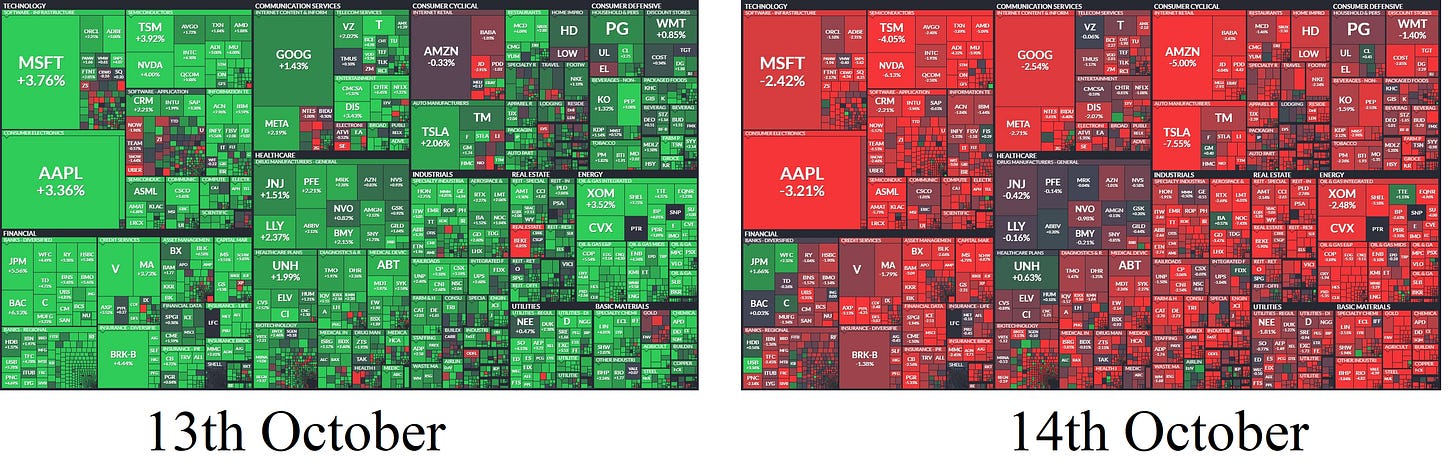

Well, you no longer need to stand in line for an hour, as markets are bringing that ride right to your home. On 13th October, we saw the 5th largest intraday reversal in the history of the S&P500 followed by a 2.3% drop the next day.

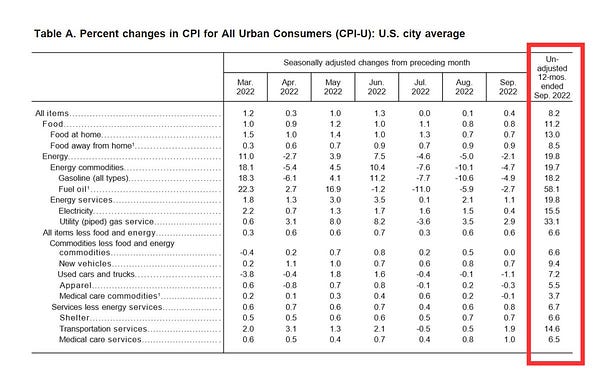

Last week, the most recent inflation data came in at 8.2%, much higher than many economists had predicted. To make matters worse, the core CPI, which excludes food and energy prices was up 6.6%, the biggest yearly gain since 1982.

At this point, it’s almost certain that we will see another rate hike in the next Fed meeting. With almost no good news on the horizon, I think we are going to see more wild swings in the market in the next few months.

Let me quickly fill you in on what I covered last week.

Although, before we go into that - as most of you know, I've been a huge proponent of saving money, living frugally, and living below my means. By doing that, I was able to save enough money to buy my first rental property, which sparked my interest in real estate investing.

However, renting out an investment property is all about balance: You need to quickly place tenants to maintain steady rental income, but you also want to protect your assets by carefully vetting the applicants* you’re considering. I learned the hard way when my first tenant stopped paying rent.

That’s exactly why I partnered up with RentPrep, where you can order a tenant background check in seconds. RentPrep streamlines the tenant screening process with its tech-driven approach and certified, in-house screeners, authenticating results. As a result, data is delivered swiftly, accurately, and in compliance with the Fair Credit Reporting Act (FCRA) and other applicable laws. I would go as far as to say that it's a must-have for any real estate investor*.

Feel free to give it a shot and let me know what you think! It's incredibly important to make sure you chose the right applicant, and the more help you have in making the process easier, the better.

How Ludwig Makes $25,000 Per Day

In my first video this week, Ludwig Ahgren takes me through his journey of doing comedy in college and selling vape in LA to becoming the most subscribed streamer on Twitch. Although he is a savvy entrepreneur now, in the beginning, he couldn’t do taxes on his own and his first employee was his roommate whom he hired for this.

Ludwig has always been candid about his gambling addiction and he noticed it first at the age of 15 during a trip to Spain with his Grandfather. It then worsened during college when he lost almost all his savings playing online poker. In his opinion, the best way to handle such an addiction is by not having money at hand to gamble.

While most streamers have a single source of income, Ludwig has successfully expanded his brand by creating several spinoffs. In this video, he talks about his new Mogul Money project, the planned chess boxing event in December, and why he switched exclusively to YouTube. He also reveals how he got scammed for $50,000, how to deal with burnout, and his biggest insecurities, so make sure you watch this one!

Congress Wants To Reset Investing

With recent studies showing that Millenials and Gen Z will need ~$3 Million to retire comfortably, Congress has proposed the “Retirement Savings Modernization Act” that will make several changes to your retirement accounts. Essentially, the traditional 401k and Roth IRA will be able to offer alternative investment assets like private equity, commodities, real estate, and even cryptocurrencies.

Critics point out that alternative assets bring in higher risk and higher fees, and this opens up employers to lawsuits as they are supposed to offer options that are in the best interest of the employees. Further, the average investor is really bad at picking individual assets for investments and with more options available, the likelihood that some people end up choosing poorly and jeopardizing their retirement is a real possibility.

In this video, I discuss the pros and cons of the new proposal, and some critical changes like auto-enrollment and larger tax credits - so make sure you watch it. I want to know what you guys think about retirement plans offering riskier investment options. Let me know your thoughts in the comments as well!

The FED Just Broke The Market

Right now, the US dollar is the de-facto reserve currency of the entire world due to its resilience, stability, and global acceptance. With the Fed raising interest rates at the fastest pace in history, the Dollar is poised to remain strong for the foreseeable future and this is causing issues across the world.

Essentially, the rest of the world is facing a double whammy: their money is losing value due to inflation, and on top of this, they are losing value due to becoming weaker against the Dollar. For example, the UK has nearly ~10% inflation and the British Pound has lost nearly 20% of its value against the Dollar.

In my third video last week, I lay out the problems affecting the global economy due to a rising Dollar and how it’s making imports more expensive for the rest of the world. The video also details how some recent developments like how the largest funds are stocking up on cash and the troubles faced by the Bank of England. Check it out!

So that’s it for my Sunday round-up. For the new folks here: In this newsletter, I give a quick recap of whatever you may have missed over the week on Sunday, and on Wednesday, I will be doing my deep-dive article on one of these topics.

See you next week with another bunch of exciting videos!

Help me grow this community by sharing this newsletter with one person whom you think is missing out by not being a part of this community. It could be a loved one or a colleague who will appreciate our weekly updates and deep dives on everything related to finance and investing.

"Essentially, the traditional 401k and Roth IRA will be able to offer alternative investment assets like private equity, commodities, real estate, and even cryptocurrencies."

Out of all of these I think only real estate should be allowed in these retirement accounts.

Commodities in a 401k sounds like absolute insanity to me.

thanks