Clearing in the clouds

The Fed is bringing it home

What’s up Graham, it’s guys here :-) If it’s your first time here, hit the subscribe button below to join 37,700+ smart investors and never miss an update on the market again. It only takes a second and is completely free.

Nothing too good or too bad stays that way forever, because great times plant the seeds of their own destruction through complacency and leverage, and bad times plant the seeds of their own turnaround through opportunity and panic-driven problem-solving.

– Morgan Housel

The Federal Reserve is the lender of last resort for the United States. Over the last year, we have seen what a massive impact it can have on the economy. After the most recent hike, we’re officially seeing the highest interest rates since the start of the Great Financial Crisis in October 2007 – and we’re seeing its consequences in the news every day, with banks going out of business even as inflation is falling.

There might be one question on your mind:

If the Fed is so effective at influencing the economy, why does it not prevent crises instead of stopping them?

One of the main reasons is that the Fed’s mandate is narrower than you think. Till 1907, the United States had no Central Bank, unlike Europe, and in the panic of 1907, banks began to collapse like flies. That crisis led to the creation of the Federal Reserve, and its main goal was to preserve trust in the American Banking system. Over time, its goals have expanded to price stability and maximizing employment. But the Fed’s interference in the market has to be careful and measured, otherwise they risk damaging the economy based on a hunch.

It’s easy to spot bubbles in hindsight. But the Fed cannot really call the top of a bubble until it happens. For example, the stock market has been considered “overvalued” a number of times, but it has continued to surpass those highs each time. Interfering with rates and being wrong could be a costlier mistake.

Either way, the Fed’s rate hikes finally seem to be working. And that’s good news, because we might be at the end of the storm. But we’re not done yet – Here’s what the latest rate hike means for your investments, what the Fed is likely to do next, and what you should watch out for in the coming months.

The Inflation Situation

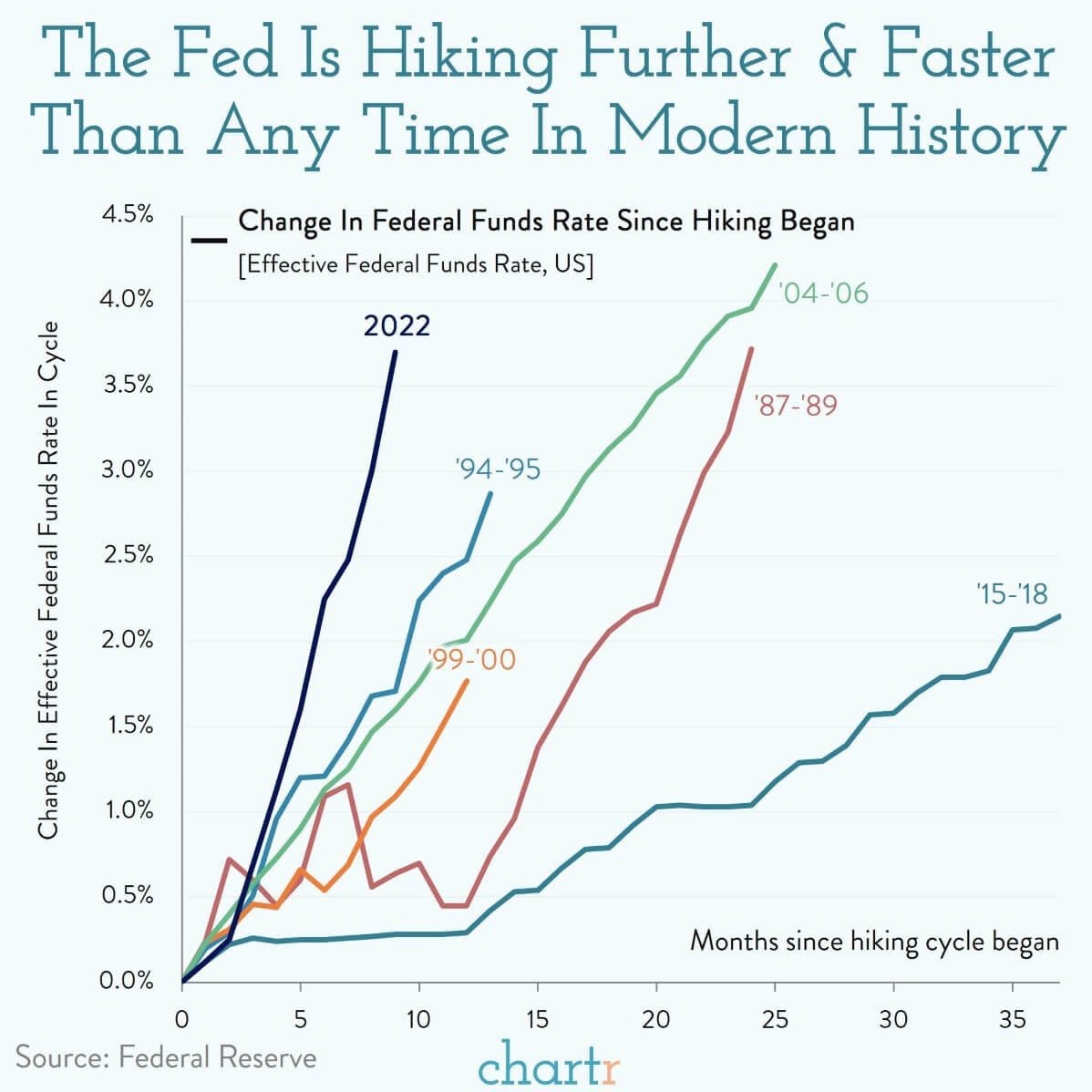

In 2022, we saw the fastest ever rate hike in history, with the mission of tackling inflation. It seems to be working, because inflation has been steadily falling from its peak of 9.1% back in June 2022. However, things are nowhere close to being over. Before we talk about the rate hike, let’s take a look at what the latest inflation report says – because that will set the context for what the Federal Reserve plans to do through 2023.

The latest inflation report on March 14th revealed that inflation is still up 6% from a year ago, with prices rising 0.4% from the month prior. If we continue on this exact same path, we could return to an inflation rate below 5% by this time next year… But there’s a problem. When we think about inflation going down, we assume that the world is going to remain as we know it, and as we saw with Silicon Valley Bank and Credit Suisse, anything can change on a moment’s notice – like the Fed’s sky-rocketing balance sheet.

But back to inflation, the biggest slice of the pie seems to be housing: The overall cost for shelter increased 0.8% Month-over-Month – or 8.1% Year-over-Year. Since housing makes up one-third of the overall inflation reading, this is quite a big deal. When you combine this with the fact that the rent index also rose 0.8% MoM and owners equivalent rent rose 0.7% MoM, inflation seems to be a lot more sticky than expected.

Are you seeing rentals fall in your part of the country? Let me know in the comments.

The good news is that rents are often lagging indicators – leases are locked in months in a row, and the data we see today is a reflection of the situation many months back. As for the current situation, national rents are beginning to drop, and this is likely to be reflected in the upcoming reports. Here’s how every other component fared:

Food increased by 9.5% over the last year, and 0.4% month over month.

Energy and Gasoline are down by 0.6%.

Used Cars are down by 2.8%.

Medical care services are down by 0.7%.

Apart from food, only a few categories have become more expensive: Apparel, electricity, and transportation services. That’s a pretty good sign that inflation is actually beginning to cool down. Now, let’s see how the rate hikes actually worked – and what’s likely to happen in the next few months.

Pain points

The 2010s were defined as the “era of 2%”. Inflation, growth, and interest rates all hovered around that level, but when it broke, nobody was prepared. Silicon Valley Bank was one of the first dominos to fall: The Federal Reserve’s rapid increase in interest rates caused their bond values to drop – and with venture capital drying up at the same time, depositors began to withdraw their funds to meet company expenses. It was the perfect storm, hitting their portfolio. The interesting part is that this isn’t unique to SVB.

US Banks are currently sitting on $620 Billion in unrealized losses from treasuries that they had bought before the rate hike, which have now fallen in value. It’s estimated that there are 186 US Banks where, if half of the uninsured depositors quickly withdrew their funds, even insured depositors could face impairments because the bank wouldn’t have enough assets to make all depositors whole – potentially forcing the FDIC to step in.

This pain is not unexpected – like water pressure building up in a plumbing system where all the valves are closed, the banking system had to crack somewhere, but nobody knew where. Rising rates have always been a recurring source of financial pain in the US. In the 1980s, a sharp rise in interest rates preceded the savings and loan crisis. The dot-com bubble burst in the early 2000s after a rate run-up. The decline of the housing market in 2008 also began after interest rates hit a high.

How are the markets reacting to the current rate hikes?

Real Estate Slowdown

The ripples in the housing market are now building up – for the first time in more than 10 years, national housing prices posted a Year-over-Year decline of 1.2%. Sellers are responding to the drop in homebuyer demand spurred by elevated mortgage rates. The time it takes for a home to go under contract after being listed is a good indicator of demand – A year earlier, 60% of homes went under contract within 2 weeks. By this February, this number was down to 44%.

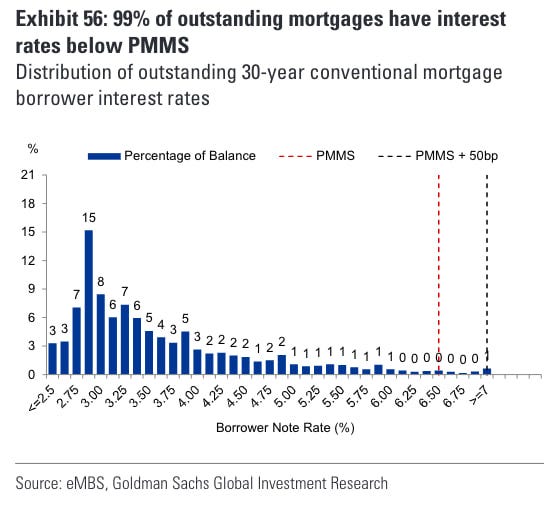

Adding to this, new listings still remain historically low. Many homeowners have already locked in a historically low rate, leading to “The Lock-in Effect.” According to Goldman Sachs, 99% of homeowners have an interest rate below what’s currently being offered on the market, and 85% of those rates are well below 5%. 63% of homebuyers have a rate locked in between 2.5 to 4% – with such attractive terms, there’s no incentive for homeowners to sell their house.

It’s also not a good time to upgrade a house – if a homeowner currently has a 3% mortgage on a $400,000 house, prices would have to drop by 35% to $265,000 for an identical house to have the same monthly payment at today’s mortgage rates of 6.5%. So unless homeowners are forced to sell, they won’t. But if you think that the lack of inventory is making it a favorable market for sellers, think again.

Goldman Sachs believes housing values are on track to fall 6.1% throughout 2023. Things could have been much worse, if it were not for the lack of new supply which is keeping home prices relatively high even in a slowing market.

But there is some good news – Even with high Fed rates, mortgage rates recently plummeted in the wake of the banking collapse, with some rates falling below 6%. This is finally prompting some buyers on the sidelines to begin making offers. It’s too early to tell if these rates will stick, but these events are leading CoreLogic to believe that home prices may start creeping back up by a rate of 3.1% YoY, because the problem isn’t a lack of demand as the sideline buyers show.

Now that’s the real estate market. The stock market tells a different story…

Contrary reaction

The market hates uncertainty – and sometimes even a bad certainty can be better for the markets. That’s because the market is always forward looking, and reflects what is likely to happen 6-12 months into the future. Now that inflation seems to be subsiding, this is seen to be a signal that rate hikes could finally be coming to an end, and that’s bullish for the stock market. The S&P 500’s price to earnings ratio is now back to the same levels we saw in 2018, because of the falling prices.

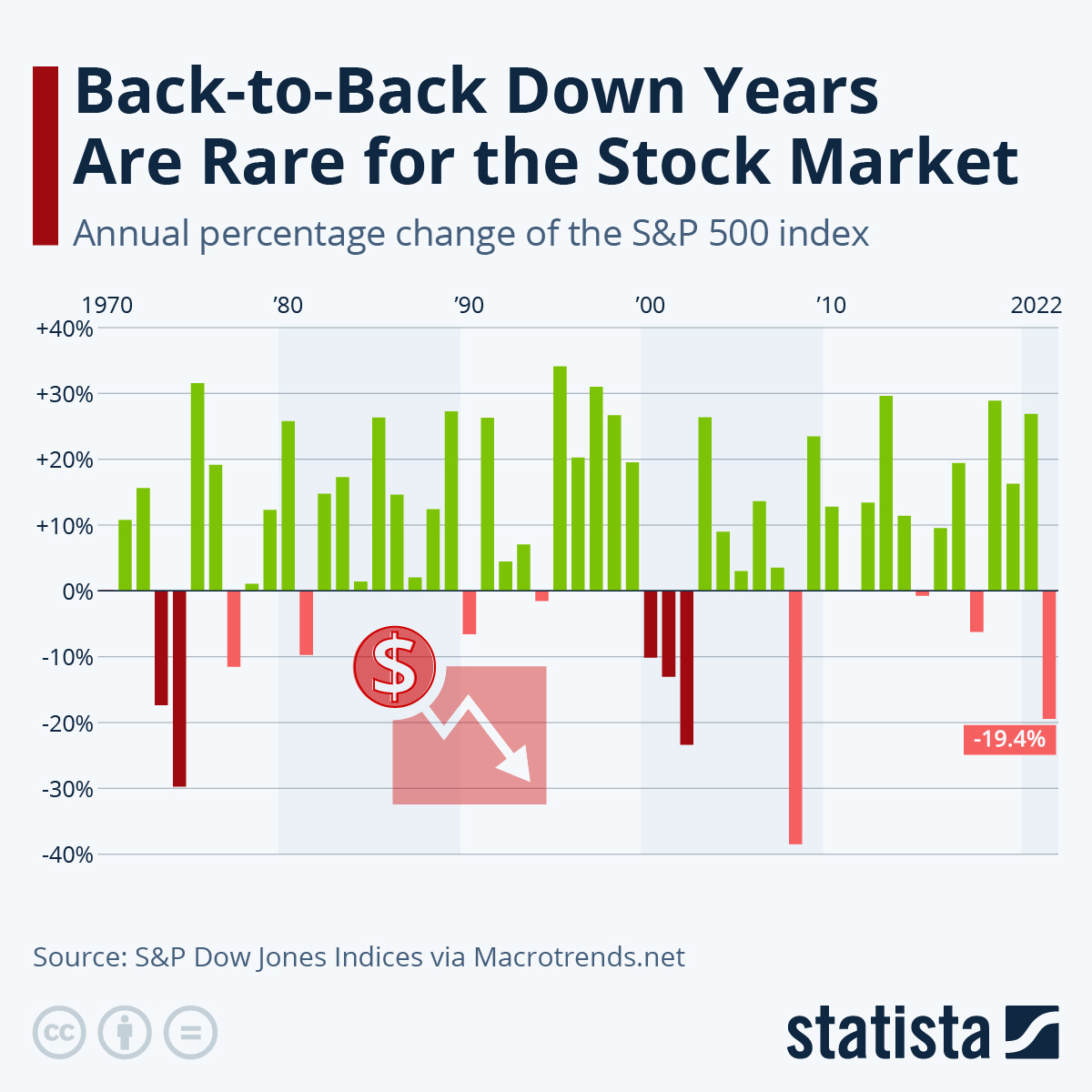

Looking at past trends, the S&P 500 has only seen consecutive years of negative returns three times since 1957, suggesting that we have a chance of being up again by the end of 2023. Analysts have mixed but generally positive outlooks on this:

A Reuters poll suggested that the market could end the year 5% up from today.

Barclays believes we could see the S&P 500 decline to 3,675.

Morgan Stanley thinks we’ll stay flat at 3,900. Goldman Sachs and Bank of America predict that the year will end at 4,000.

J.P. Morgan is the most bullish of the lot – predicting 4,200 by December 2023.

But then again, Credit Suisse said something similar to J.P.Morgan… and, we all know how that turned out. The spread between the best and worst case scenarios are the largest we’ve seen since 2009, with estimates ranging from the SP500 going to 3,600 all the way up to 5,000.

So, basically, no one has any clue what’s going to happen and the market reacts to arbitrary numbers that change by the minute. Speaking of arbitrary numbers, let’s wrap this up by looking at where the rate hikes are likely to end.

Light at the end of the tunnel

The Fed raised rates by an additional 25 basis points, as expected – despite the banking turmoil. It’s a tough job to fight both the banking crisis and inflation, but right now, they seem to be on course. On a broad scale, the Federal Reserve has indicated that we could expect a peak Federal funds rate of 5.1% by the end of 2023. That means, we probably have two more rate hikes ahead of us, on May 3rd and June 14th. Beyond that, it’s going to be a “wait-and-watch” scenario to see if inflation begins to come back down.

If inflation stabilizes, then they would hold these rates steady for the market to adjust. If it doesn’t then rates are probably going higher – either way, rates are going to be high for longer than expected, and we’re not seeing a reversal anytime soon. On a positive note, even though the potential GDP numbers have been revised downwards, there’s nothing that indicates a recession (hard as that might be to believe). The reason is that they don’t expect the unemployment rate to drop below 4%, and in the process, we could avoid the hard landing predicted by so many.

We’ll have to see if that pans out, but the projections seem hopeful. Another factor that wasn’t accounted for earlier is the banking crisis – though it’s not a pretty situation, the crisis is having an effect similar to an additional rate hike, because lenders are pulling back and tightening credit conditions. This reduces the need for the Fed’s interference because the economy is slowing down without their involvement.

As for my own thoughts, here’s what I have to say: We didn’t really get anything we didn’t already know, but that’s good news – The Federal Reserve is committed to its fight against inflation, they are trying to get back to their 2% target, and they don’t want the entire economy to implode in the process. The bigger issue right now is simply mitigating a banking crisis, by restoring faith in the system.

Rate hikes are making it difficult for banks to stay afloat, because they have money locked away in bonds that are falling in value. As a result, the Fed now has to carefully balance inflation versus the overall health of the banking system. Just look at the Fed’s balance sheet – essentially, they were able to “buy out” unprofitable bank loans and hold them to maturity. As a result, they have taken on more debt.

All of this just complicates an already delicate situation – that’s why I believe that they’re likely to continue taking a wait-and-see approach for the rest of the year. There’s a chance that they could temporarily pause a rate hike in the future and come back to it once market conditions improve – but I think we’re in for a much longer ride than expected.

Stay safe, stay invested, and I’ll see you next week – Graham Stephan.

Hours of effort and research went into making this ten-minute read. If you found it insightful, please help me out by clicking the like button and sharing this article.

Just resigned my lease. For reference I am in a "Luxury" Apt in downtown st petersburg FL. Aka the tampa bay area. Now this is an area that has been said is not going to come down as far as other places in the country. But my renewal letter came and for a 12 month lease, we could resign for $100 less than we were currently paying.

Thanks for breaking it down so someone like me can understand! I appreciate your insight.