What’s up Graham, it’s guys here :-) If you would like to join more than 21,300+ members and never miss an update on the market, hit the subscribe button below. It only takes a second and is completely free.

A little more than a hundred years ago, a large-scale rat plague happened in Vietnam. Back then, it had only been a few years since it was identified that rats could be vectors of diseases, so authorities were keen to stamp it out quickly.

So they instituted a policy that provided a bounty for every rat killed. You could claim the bounty by showing the tail of the rat you killed (Fun fact: Louisiana pays a $6 bounty for every swamp rodent killed). However, this soon backfired as enterprising locals started breeding rats for additional income.

When the government finally realized and canceled the bounty system, locals released the rest of the rats, thus increasing the overall rat population.

You see, a critical point that authorities failed to envision in Vietnam was how their policy would encourage bad behavior. Because of this, their well-intentioned policy achieved the perfect trifecta of failures: they wasted money, lost public trust, and made the problem worse than before. This is also known as Goodhart’s Law - “When a measure becomes a target, it ceases to be a good measure.”

Like any democracy, we in the United States have also had policies that ended up encouraging bad behavior. The worst offenders in this regard are corporate bailouts. You know the drill by now: Executives make irresponsible investments that take their companies to the brink of collapse, only for the government to use taxpayer money to bail them out.

In such cases, we are often given a justification: these companies are too big to fail: i.e. their collapse would have such a catastrophic impact on the overall economy, that it is better to bail them out.

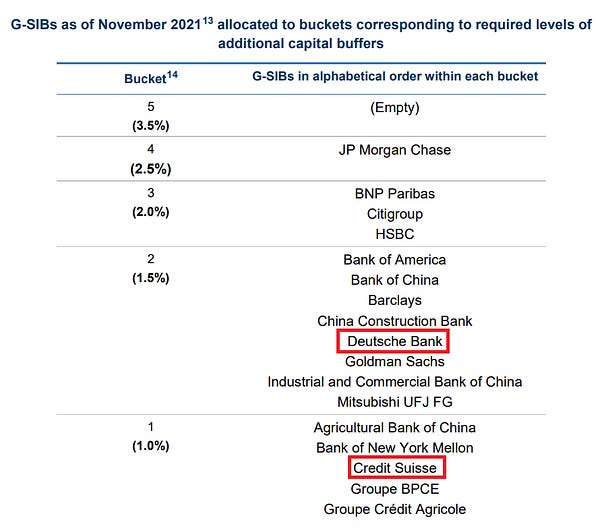

With an increasing amount of chatter regarding large firms like Credit Suisse and Deutsche bank being on the brink, there is renewed interest in this topic. But it also raises some questions. Where does corporate responsibility end? Are we, the taxpayers doomed to bail out any company as long as they are large enough? But before we start, I want to know your thoughts on corporate bailouts.

This week, let’s take a look at what makes companies too big to fail, what is going on with Credit Suisse, and whether this can spiral out of control like the 2008 crisis.

Who is too big to fail?

It is easy to be generous with another man’s money - Latin Proverb

As I learned more and more about finance, I realized a fascinating thing. Despite all the bureaucracy and legalese involved, even at the highest levels, transactions are based on two abstract concepts: trust and reputation.

An example of this is the US national debt, which just crossed $31 Trillion: nearly 1.5 times our GDP. There’s been no dearth of economists warning about a debt crisis (I had covered the debt crisis a few months back, the link is here ). Yet, the demand for treasury bonds has not decreased. Want to know the reason? It’s because there is no safer place to park your money than in a guarantee from the US Government.

The banking system works in a similar way. The banks provide a steady line of credit for businesses trying to expand, at the same time, providing a safe place for the average citizen to deposit and protect their capital. Reliable and trustworthy banks are the pillars upon which the modern economy is built.

If the public loses faith in the banking system, it can bring the economy to a standstill. After all, if the income from your hard work cannot be stored safely, what is the point of even going to work?

Most recently, we saw this in China, where protests erupted in several parts of the country after people were stopped from withdrawing their money from the banks after a corruption scandal. A few months back, I had done a deep dive into the crisis in China.

Realizing the importance of the banking system after the 2008 financial crisis, countries across the world came together to make a list of systemically important financial institutions (SIFIs) whose failure might trigger a global financial crisis. The list is an indirect admission: the SIFIs are “too big to fail” and will likely be bailed out in times of crisis.

Right now, two members of the list are reportedly on the brink.

Scandal in Zurich

If you owe the bank $100, that’s your problem. If you owe the bank $100 Million, that’s the bank’s problem - J. Paul Getty

With a combined $3 Trillion in assets under management, Credit Suisse and Deutsche bank are undoubtedly some of the world’s most prominent banks. The stocks of both these banks have taken a heavy beating in the last few years, having fallen more than 90% from their peaks!

To make matters worse, neither of these banks has been on their best behavior. There have been several instances where they have been accused of unscrupulous activities.

In 2017, Credit Suisse paid a $5.3 Billion fine for over-valuing mortgage-backed securities during the 2008 crisis.

In 2009, Credit Suisse forfeited $536 Million for violating the International Emergency Economic Powers Act.

In 2017, Credit Suisse lost $4.7 Billion from a failed investment firm that defrauded its clientele.

In 2007, Deutsche bank was fined $7.2 Billion for misleading investors with irresponsibly issued mortgages.

In 2015, Deutsche bank was forced to pay $2.5 billion for “rigging interest rates”

However, most of the recent interest in these organizations arose due to a recent story in ABC Australia, which reported that a major investment bank is on the brink. Now, they didn’t mention a specific name, but there was a strong rumor that they were referring to Credit Suisse, particularly because their CEO recently mentioned that the bank is facing a critical moment.

Now, with rumors as strong as these, it’s important for firms with such strong reputations to emphatically refute them with data. However, last weekend, Credit Suisse executives began reassuring their investors that “everything was okay”, which understandably had the opposite effect. After all, it’s never a great look for a bank to call you on a weekend to inform you that everything is fine.

Further, their CEO made a statement that the firm has a “strong capital base and liquidity position” and investors shouldn’t worry about the day-to-day price of the stock. But now, reports are emerging that Credit Suisse is selling its hotel in Zurich to shore up liquidity.

Return of the Lehmann

Quick question: if you are the chairman of a large bank that is reportedly on the brink of a crisis and you want to shore up faith in the firm, what is the worst last name that you can have? Well, meet Axel Lehmann, the chairman of Credit Suisse.

Jokes apart, that’s not the only reason why people are worried about the situation turning into another Lehman-like moment. For that, we have to get a bit technical.

When banks issue a loan, they have the option to purchase a Credit Default Swap (CDS), which acts as insurance in case the borrower doesn’t pay back the loan. Essentially, the bank transfers the risk of the loan to another bank for a small annual fee (also called the ‘spread’ of the CDS). If the general sentiment is that the bank issues safe loans (i.e. most of the loans will be paid back in full), then the fee that the bank has to pay for buying a CDS will be low.

As you may have guessed by now, the Credit Default Swap spreads for Credit Suisse have been on the rise: so much that they have reached 2008 levels. What this means is that investors are pricing in a strong likelihood that one of the largest banks in the world is about to go under.

Crystal Ball

Based on recent news, things are not looking good for Credit Suisse. A stress test in 2022 suggested that the lagging Tier 2 Capital means the firm lacks the necessary capital to restructure successfully. Credit Suisse is also trying to scale back its operations by cutting 5000 employees and its co-head of global banking is suddenly leaving, after 27 years of working in the company.

Overall, it is clear that Credit Suisse is at a difficult point right now: however, there isn’t enough information at the moment to confirm that this is another Lehman-like scenario. Most importantly, even if a crisis were to occur, a key factor is - what the government will do. Given the lessons we learned during the 2008 crisis, we might see another Trillion Dollar bailout before that.

Sidenote

A thread I had made on this topic had gone viral on Twitter [link].

I want to know what you guys think about corporate bailouts.

Do you think that governments should be bailing out companies using taxpayer money?

Should such financial support come with some clauses?

Should we regulate large financial institutions more?

Let me know in the comments below!

A lot of effort and research went into making this article, so if you found it insightful, please help me out by clicking the like button and sharing this article.

Very good article

Insane value-adding article <3

I personally did some digging, comparing both CS (2022) and Lehman (2008)'s balance sheets. Specifically cash on holdings, securities exposure and also their leverage ratios. As of now, CS is definitely not like how Lehman is like back in 2008. But hey, time will tell...